Four months ago, at the start of 2024, we said we thought that US equities looked pretty fully valued. Even so, we also said that we thought the S&P 500 might have further to rise on the back of positive market sentiment.

Two months ago, markets were even higher, and we wrote about investors partying like it was 1999. At the time, I asked whether this was a revival of the dotcom bubble.

NVIDIA peaked on the 25th of March, and the S&P 500 3 days later. Since then, the S&P 500 declined 5% and NVIDIA 20% before both index and stock recovered some of the lost ground. Volatility is back.

Inflation isn’t slain yet

Up until late March, there was still hope that inflation was more or less under control, and that the Fed would start cutting rates. That hope has been put on pause for now. US inflation has come down significantly from 2022, but it is still stubbornly high.

Cue the Fed and Powell, who have been rethinking interest rate cuts in the face of stubborn inflation numbers. Here is Jerome Powell on April 16th: “Given the strength of the labour market and progress on inflation so far, it is appropriate to allow restrictive policy further time to work and let the data and the evolving outlook guide us”.

So the Fed keeps looking at its favourite data points, and it doesn’t much like what it sees. However, its pessimism may be excessive. The Truflation team has US inflation at 2.49% as of the latest reading, vs. the Fed’s reported 3.5% rate. As the FT Alphaville Team points out, fears about inflation stickiness might be overdone.

So there are clearly two sides to the story. Even so, it’s likely that we will get fewer cuts than hoped for in 2024. And thus markets are taking a breather and going soft.

Have the Magnificent Seven run out of Steam?

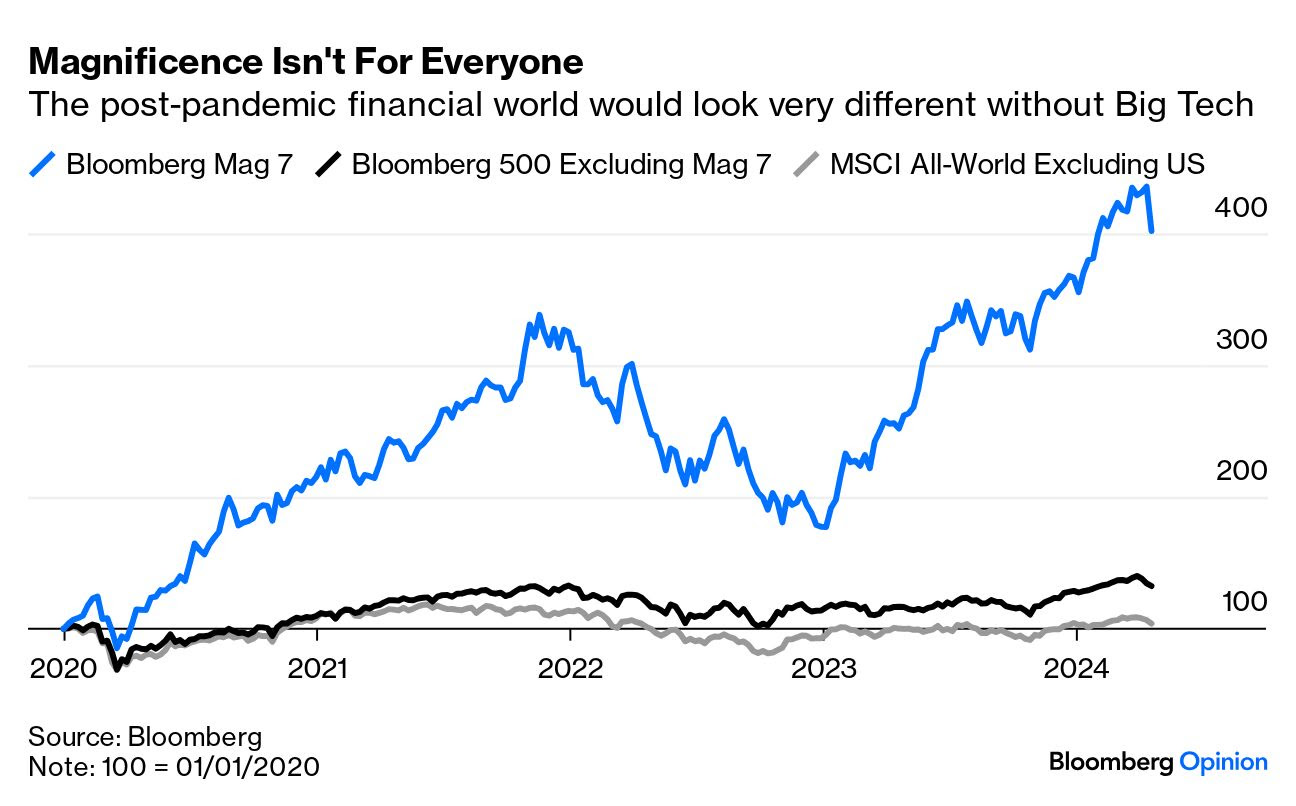

Since US Markets bottomed out in October 2022, the runup to current levels (+40%) have been powered by the Magnificent Seven (Apple, Google, Facebook, Amazon, Nvidia, Tesla and Microsoft). Investors have (in many ways correctly) treated the Seven as an unbeatable block of growth and profit. All driven by exceptionally dominant positions in their respective areas of technology.

But start scratching under the surface, and we can see that the party might be coming to an end.

While the Mag 7 are still up way above their position as of a year ago, the last month has been challenging. And there might be further headwinds.

Look under the covers:

- Apple is struggling to explain where future growth will come from. Demand for iPhones has gone into a tailspin in China, and the pipeline of new blockbuster products looks bare.

- Tesla is still growing modestly, but the company has missed Earnings Per Share for the past two quarters. And there are worries that both revenue and profit could be put under pressure from Chinese manufacturers:

- NVIDIA has had an incredible run over the past 18 months on the back of the LLM/AI boom, but there are major questions as to whether the company can keep up the current combination of growth and profit margins (which would be needed to justify the valuation).

- Facebook/Meta has also had a formidable run since the start of 2023. But a lot of the performance was driven by cost optimisation as the company got lean and trimmed investments in the Metaverse, leading to better operating profits. The company is theoretically well-placed to benefit from AI, given its massive data trove. However, as Meta felt it was behind Google and Open AI in the LLM race, it took an early decision to open-source its own LLM (Meta Llama). This potentially caps the upside of any benefit Meta can derive in the AI space.

- Google was widely seen as the indisputable leader in AI prior to OpenAI’s launch of ChatGPT. For more than a decade, Google (and Google Deepmind) produced world-leading research in the AI field. However, internal cultural issues have slowed down the pace of innovation at Google, exemplified by the botched launch of Google Gemini earlier this year. Gemini is in many ways an awe-inspiring product, and Google certainly hasn’t been knocked out yet. But with its core business model (search+advertising) under assault from LLMs, many are questioning future growth prospects.

Amazon and Microsoft – the two remainders – have their own challenges. But even if we accept that they are formidable companies, it’s hard to see those two pick up the slack from the other five to continue to drive the stock market all on their own.

So where are the growth opportunities?

As early-stage tech investors, we are unapologetically optimistic here at SuperSeed. That said, there has been some grim reading in the global news columns so far this year. It does not look like the war in Ukraine is drawing to a positive conclusion in the near term, and Israel’s conflict with Iran’s proxies Hamas and Hezbollah have threatened to engulf the wider region. On a macro scale, this is all “bad for business”.

At the same time, there were hopes of a rapprochement between China and the US following November’s largely successful summit between Xi Jinping and Joe Biden. But the underlying conflicts have not gone away. The US is unhappy with China’s support for Russia, and China is unhappy with the US’s support for Taiwan. And there are a host of other issues underneath these.

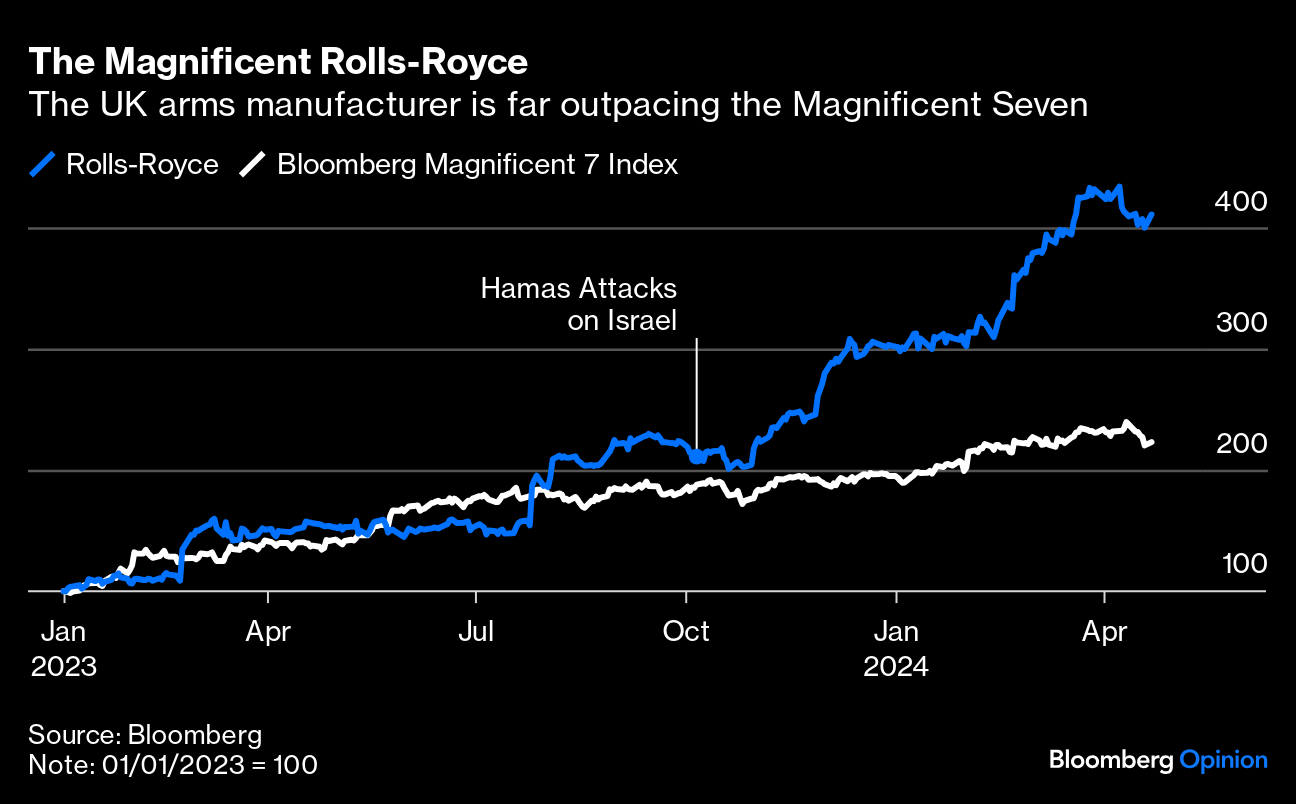

So rather than collecting a “peace dividend”, everyone is now busy restocking their weapons arsenals. The UK government has announced a targeted increase in defence spending from 2.3% to 2.5% of GDP.

While all of this might be bad for peace (at least in the short term), it’s good news for arms manufacturers. Rolls-Royce, for instance, has quadrupled in share price in less than 2 years.

Wherever you find yourself on the hawk/dove scale, defence manufacturers and cybersecurity companies are likely to benefit in the years ahead.

What’s happening in venture capital?

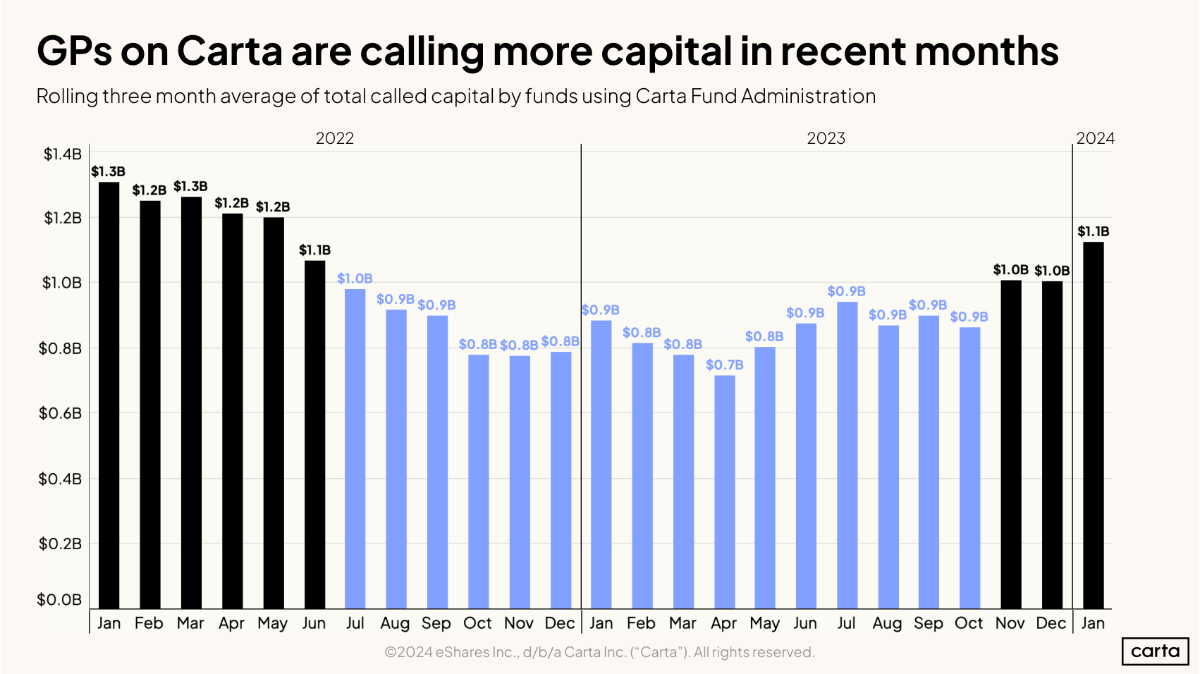

While 2023 was largely a year of going sideways, the VC industry has started to rebound in recent months.

US fund administration platform Carta reported that VC fund capital calls, finally, are on the rise again. While it is still too early to tell whether this is a bona fide new “cycle,” the data is certainly showing green shoots.

Anecdotally, we are feeling spring-time in terms of deal-flow and velocity as well. But where is the activity?

In many ways, AI is still the only game in town. AI has driven expectations (and market cap) for Microsoft, Google and NVIDIA, and AI has also continued to drive investments in early-stage tech companies.

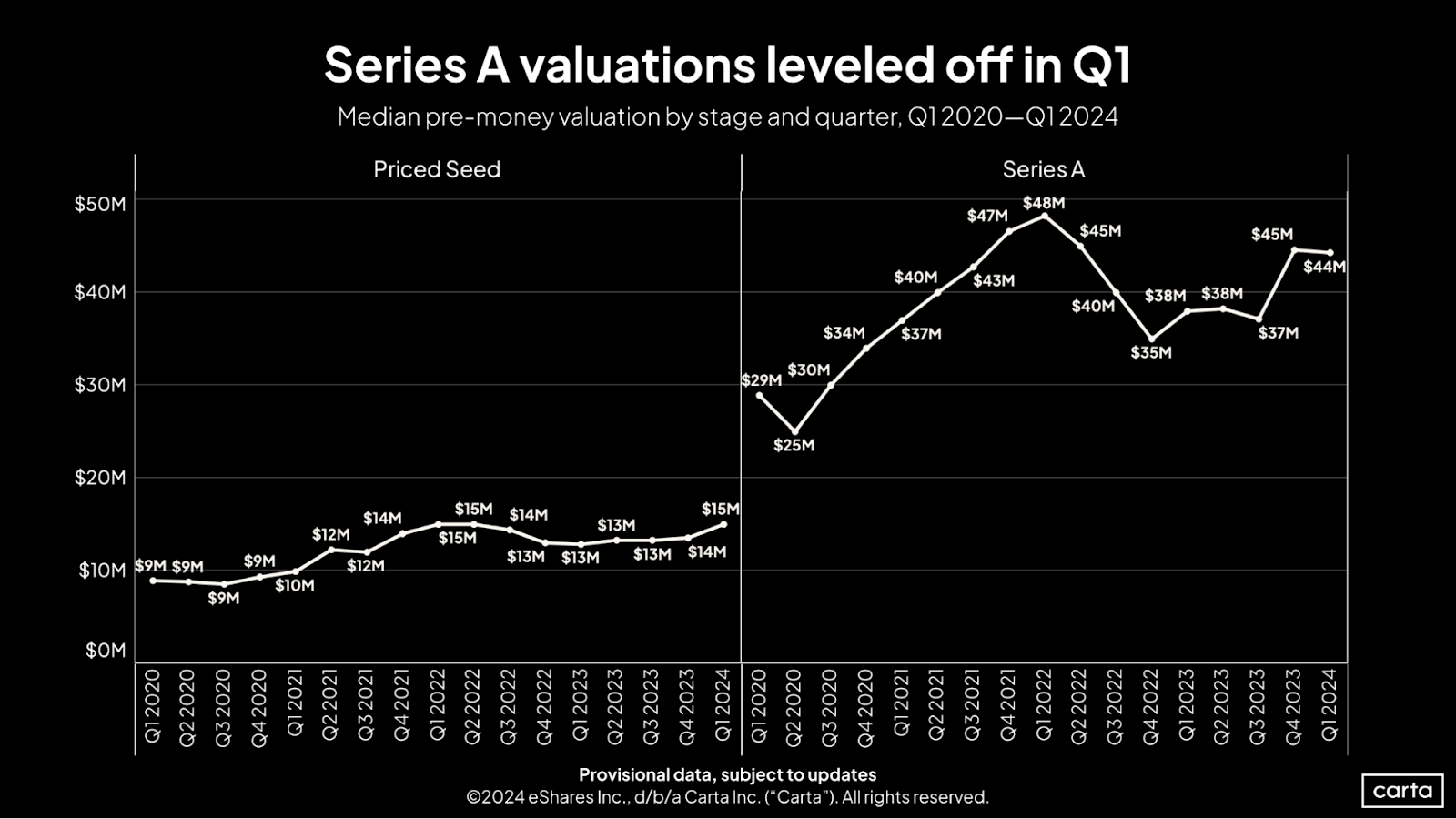

While US seed valuations ticked up in Q1, Series A valuations were largely flat on Q4 (but still well up on the nadir from Q4 2022 to Q3 2023).

Where are the opportunities?

In March, we looked at areas for early-stage investment opportunities. This month we are going to dive more into opportunities in vertical applications, including some of the AI tooling that enables these opportunities. You can read more here.