Investing in the future

The opportunity

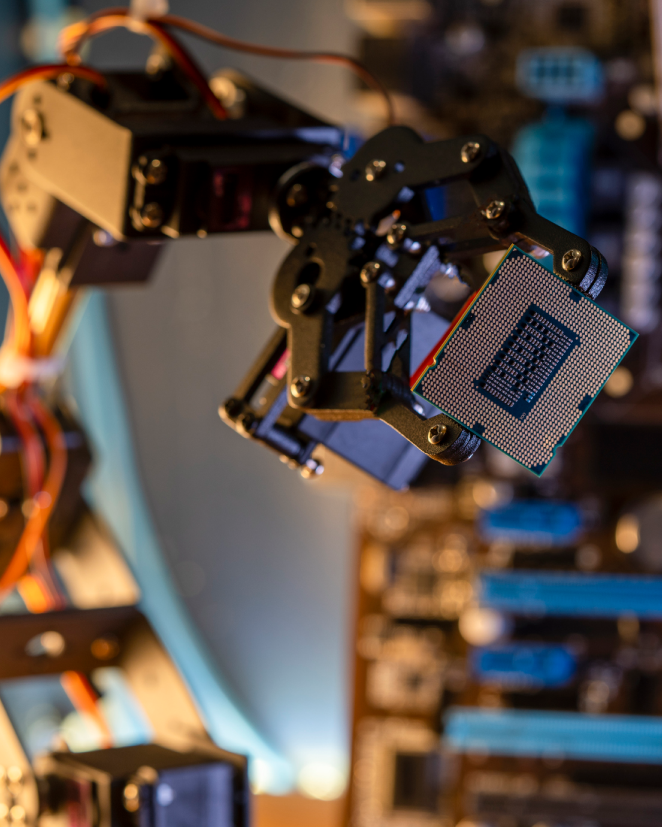

Business Automation

Computers have been transforming business for more than 50 years. But in many ways, we are still only getting started on the journey to take advantage of the way in which computers, software and AI can transform the world of business.

The next generation of artificial intelligence, blockchain and computer processing power (quantum) is ushering in new opportunities to augment human capabilities and automate business processes.

SuperSeed backs the founders that make this all possible. We invest in the companies that create the next generation of business technology and then help the companies commercialise their technology to bring the future one step closer.

We are entrepreneurs by trade. We have been in the startups trenches. We know how difficult it is to build a business and what it takes to succeed. And we use that experience every day to find and support the best founding teams in building the technology leaders of the future.

The investment strategy

We invest at the Seed stage where the need is greatest and where capital and support from investors can make the biggest difference to founding teams. This means we can buy into the technology champions of tomorrow before valuations skyrocket.

We invest broadly within business automation, including in

Industry 4.0, Supply Chain & Logistics

Enterprise Automation

AI, Dev & Data Tools

B2B Marketplaces

CyberSec

Value for Investors

Investing with SuperSeed provides investors with access to a diversified portfolio of technology startups with potential for high growth and outlier returns.Investing in technology startups can offer great rewards, but it can be difficult territory to navigate. Through SuperSeed, investors get

Go-to-market

We can help develop the right go-to-market model.

Hire

Support hiring with our in-house talent team.

Connect

Open doors to connect with customers and investors.