NVIDIA: A pick & shovel love story.

Whenever a new technology arrives, there’s always a sympathetic ‘pick & shovel’ narrative from pundits, based on the economics concept of derived demand. With the recent step shift in AI’s capabilities, it’s NVIDIA’s time in the sun.

Don’t invest in AI – invest in companies enabling it.

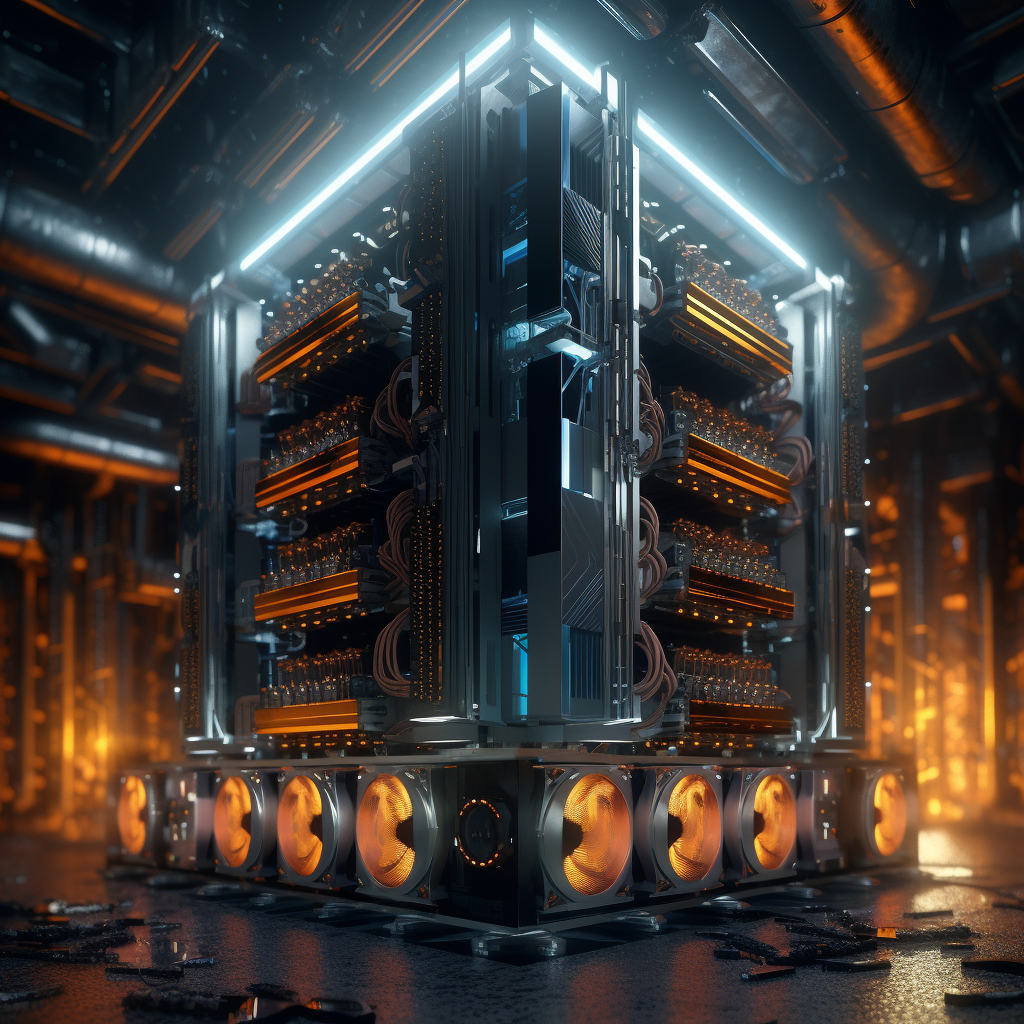

NVIDIA have built the GPU based architecture on which the AI revolution lives. As an example, Microsoft’s OpenAI uses thousands of their latest H100 GPUs interconnected by Quantum-2 InfiniBand networking, delivering exascale AI supercomputers to the cloud (exa = 18 zeros). To put in context how powerful an exascale computer is – for every second of its use, a person would have to perform one sum every second for 32 trillion years just to equal its performance.

Will NVIDIA be the big winner in this (r)evolution? I think so: they’re incredibly well placed to be, and the stock market thinks so, too.

If you go to their website it looks like they own the entire industry and had they been able to complete their purchase of ARM last year, it wouldn’t have been far from truth.

NVIDIA was founded 30 years ago by Jen-Hsun “Jensen” Huang, Curtis Priem and Chris Malachowsky at a Denny’s in San Jose on Jensen’s 30th birthday. Their story is one of being bold, zigging while others zagged, and staying the course through several potential bankruptcies.

At one point, Jensen notes, the company was “30 days from game over”. “At NVIDIA, I experienced failures — great big ones. All humiliating and embarrassing. Many nearly doomed us.”

What’s their secret?

Bold – In 1999, NVIDIA released the GeForce 256, the world’s first graphics processing unit (GPU). The GPU revolutionised the graphics industry, and it is now used in virtually every computer and gaming console. Most people thought it would be the CPU, not the GPU that would win.

Forwardthinking – In 2012, NVIDIA released the Tesla K20, the world’s first GPU designed specifically for artificial intelligence. The Tesla K20 helped to accelerate the development of AI, and is now used in a wide variety of AI applications, including self-driving cars, medical diagnosis, and fraud detection.

First – In 2018, NVIDIA released the DGX-1, the world’s first AI supercomputer. The DGX-1 is used by researchers and businesses to train and run large AI models. The crypto boom boosted the bottom line with GPUs used primarily for mining.

Why is any of this important right now?

“We have reached the tipping point of a new computing era,” Jensen says, arguing that AI now enables anyone to code, simply by typing natural language commands. “Everyone is a programmer now. You just have to say something to a computer,” he added, describing this combination of accelerated computing and generative AI as “a reinvention from the ground up”.

I think he’s right: it’s what we focused on as a firm before the hype, and will continue to do so. But – to peel the magnitude of NVIDIA’s ‘moment’ from the ceiling for a second – it is worth pointing at the flashing neon financial health warning.

$NVDA is currently trading at 37 times revenue (P/S) and 202 times earnings (P/E)! Is it worth that? Well, it depends on which hand you’re looking at, and through which coloured lens, but historically, these kinds of metric have not ended where they started…

As Scott McNealy, the CEO of Sun Microsystems told Bloomberg in 2002 after the dot-com collapse:

“2 years ago we were selling at 10 times revenues when we were at $64. At 10 times revenues, to give you a 10-year payback, I have to pay you 100% of revenues for 10 straight years as dividends.

That assumes I can get that by my shareholders, and that I have zero cost of goods sold, which is very hard for a computer company. That assumes zero expenses, which is really hard with 39,000 employees. That assumes I pay no taxes, which is very hard. And that assumes you pay no taxes on your dividends, which is kind of illegal.

Do you realise how ridiculous these basic assumptions are? You don’t need any transparency. You don’t need any footnotes. What were you thinking!?”

AI is not a bubble

The only counter to McNealy is that this is not the dot.com, and there is no Linux to nail the coffin shut. While everyone balked at Meta’s IPO, and thought Google was expensive, NVIDIA is certainly NOT Uber, Robinhood or WeWork. Likewise this tech evolution is not crypto, Web3, or Metaverse nonsense: I am confident AI is going to transform every facet of our lives for the better

Let’s see where this can go. Not only will we continue to invest in picks and shovels but also the startups who are using them to transform how we work.

I look forward to the McNealy debates driven by our founders.