Just how is the UK economy doing?

We talk a lot about the US because the US ecosystem governs the mass and direction for VC and startups globally, but America is not the whole story.

As founders learned to understand new investor and customer behaviour in 2023, it became clear (to many who’d never experienced a downturn) that it was a change in client desire that was most surprising and difficult to navigate.

Founders experienced an unusual drop in sales, longer sales times, requests for new offerings, and a palpable shift in energy. For UK startups, much of that was, and still is, a local UK problem.

So how are we doing, what will the commercial appetite be, and where will the UK economy land in 2024?

That’s what I’ve set out to explore in this note.

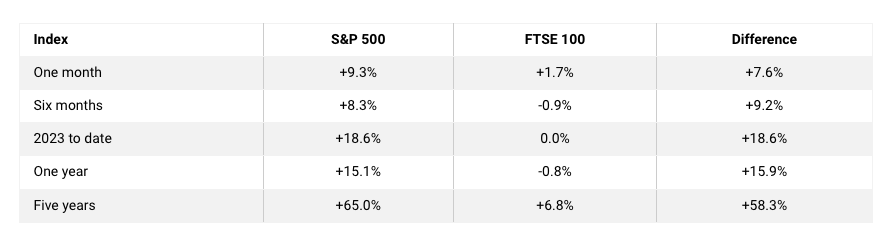

To set the enterprise scene and for context I wanted to get a sense of business from both sides of the pond. It’s an unfair comparison but to look at public markets it looks at first glance, that…

…historically the S&P 500 crushes FTSE 100 performance,

and has done for more than the five years in the chart shows.

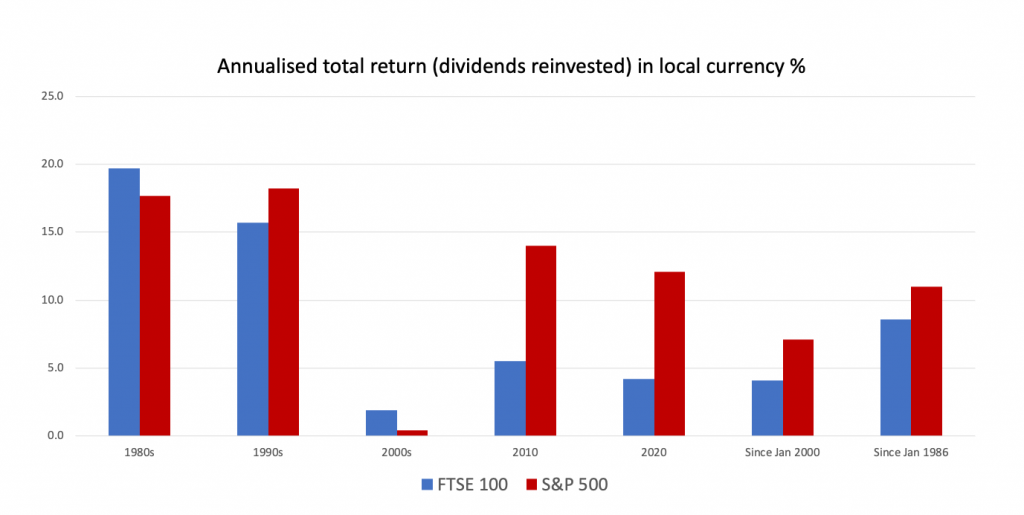

However, when including dividends it levels the field, a little.

As a side-note, does that make UK stocks cheap by comparison? Maybe, but pundits have been saying that for at least a decade.

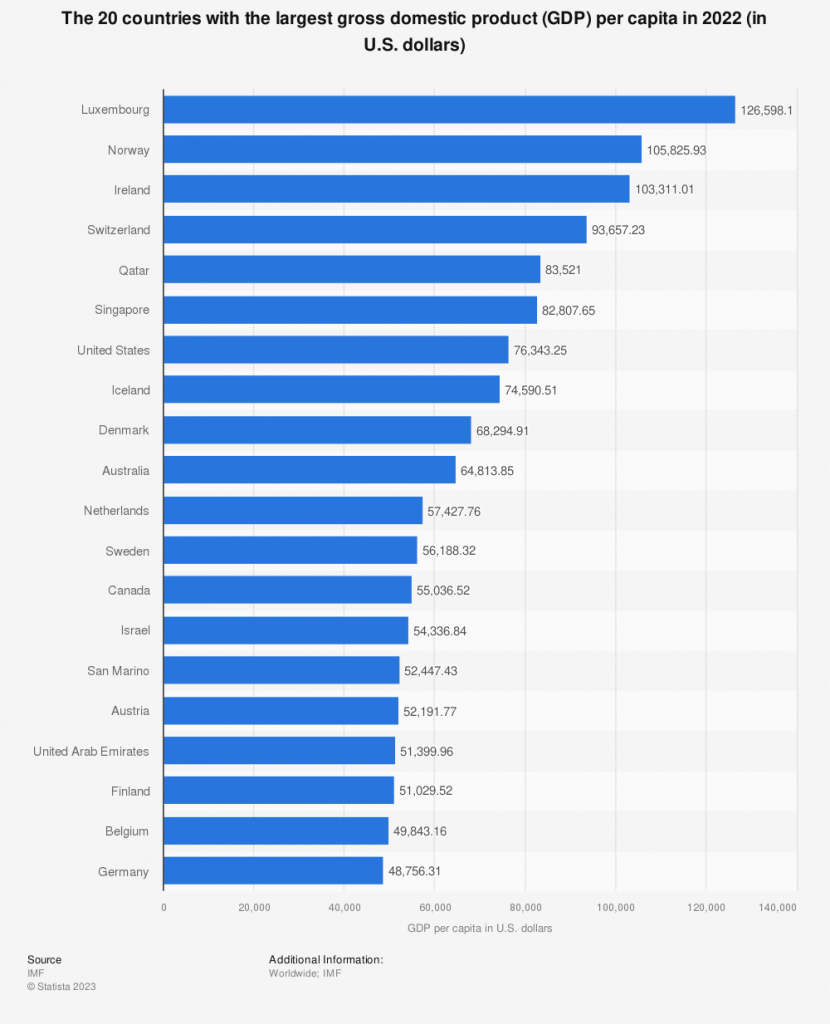

Other performance proxies are GDP per capita, and growth. Re GDP per cap the UK doesn’t even hit the top 20 (In 2022 we were placed 22nd ($46k), if we include Liechtenstein). 11 European countries do make the list, the US is at 7 and there’s an obvious no-show for the powerhouses of India & China.

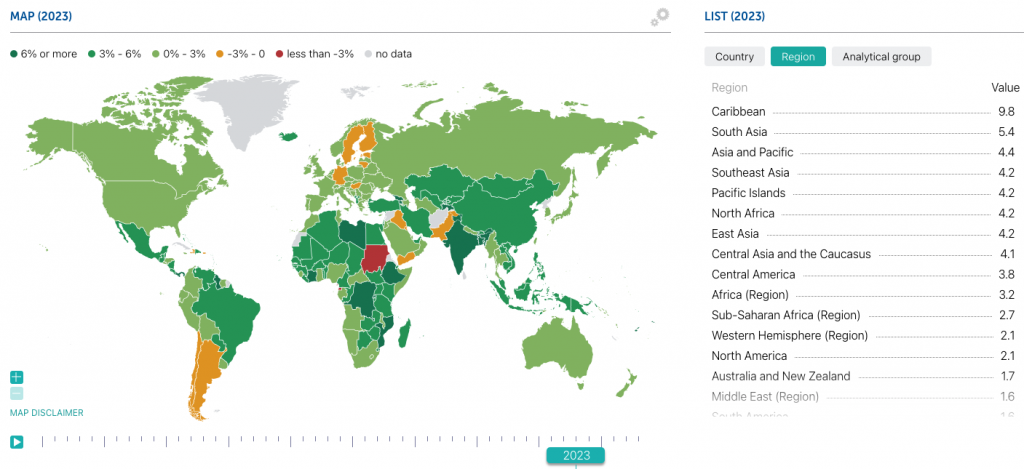

Looking at global GDP performance in 2023, Europe is the weakest of all the regions, being bottom of the list. So far down we don’t even display on the site at 1% (source: imf.org).

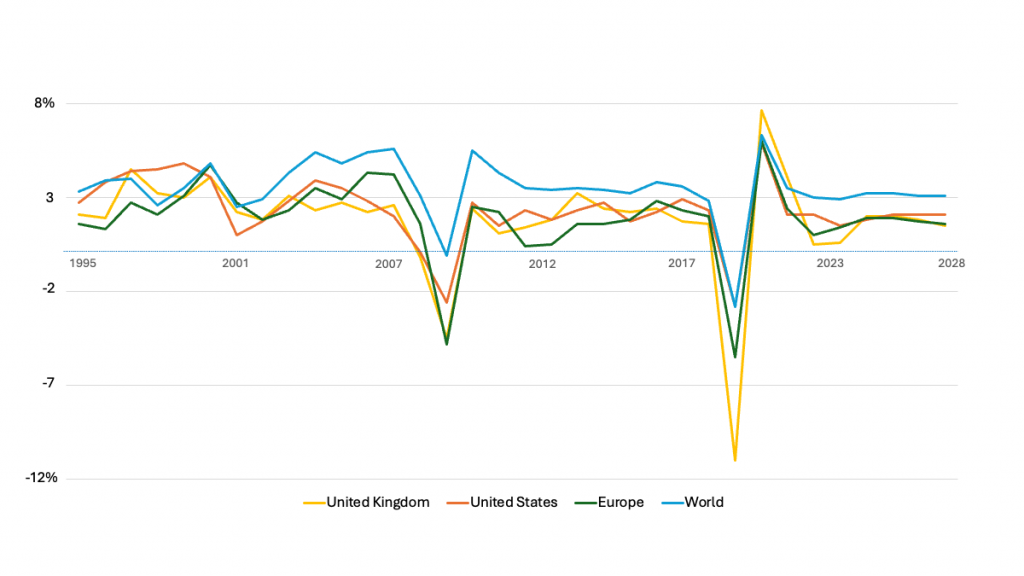

Below is GDP growth in the UK vs US within the context of Europe and the rest of the world. An ominous low growth 4 year plateau from now until 2028 is only upstaged by Europe continuing on a downslide (also via imf.org).

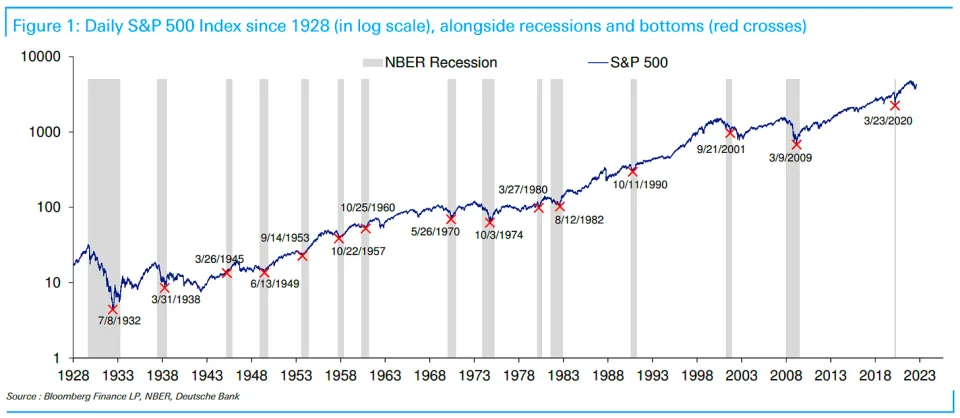

Startups need any kind of activity to flourish, regardless of good bad, bull or bear. Appreciating and leveraging the fact that markets are cyclical. Both fear and greed are ultimately great for startups, even if it doesn’t feel like it at the time for any stakeholder.

On the downslide we get innovation, clearing of the decks and the opportunity to steal a lead – driving strong vintages.

On the upside, for startups and investors alike, we get to see VC scale growth which ultimately means more liquidity and recycling, to serve the next market cycle… rinse / repeat.

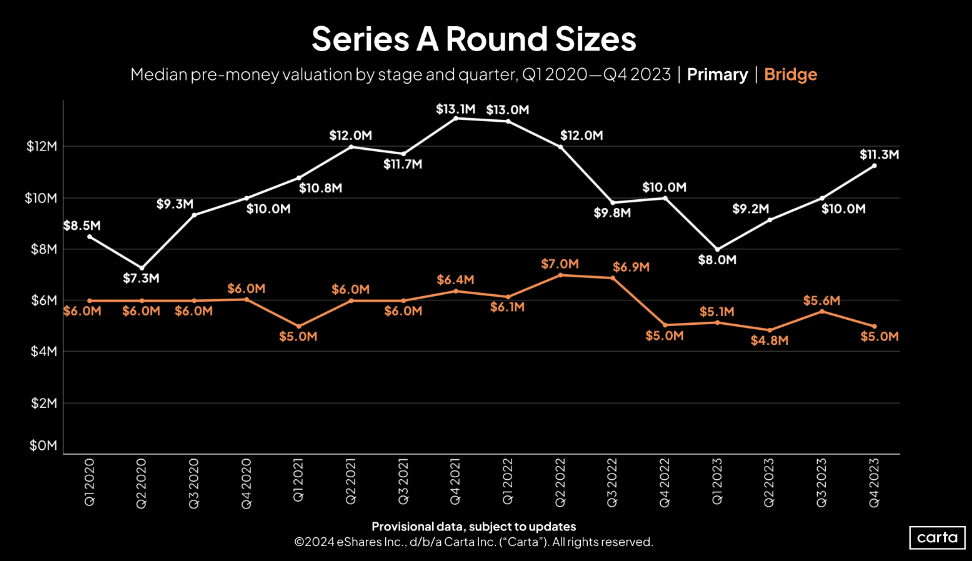

The later stage investment cycle is starting to open up which is great news for the full investment stack. According to Carta, series A round sizes and valuations bounced up in Q4 2023. Valuations landing just 14% off the 2021 high, with round sizes only down 7%.

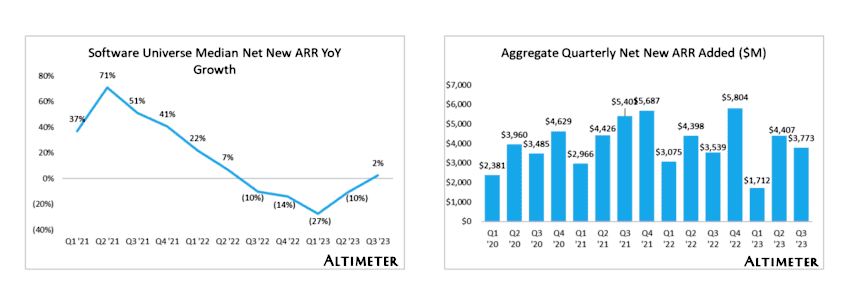

Looking at software, and specifically the state of SaaS, we’re seeing a rebound here too in net new ARR. The end of 2023 seeing a meaningful uptick, customers are out buying again after 18 months of decline.

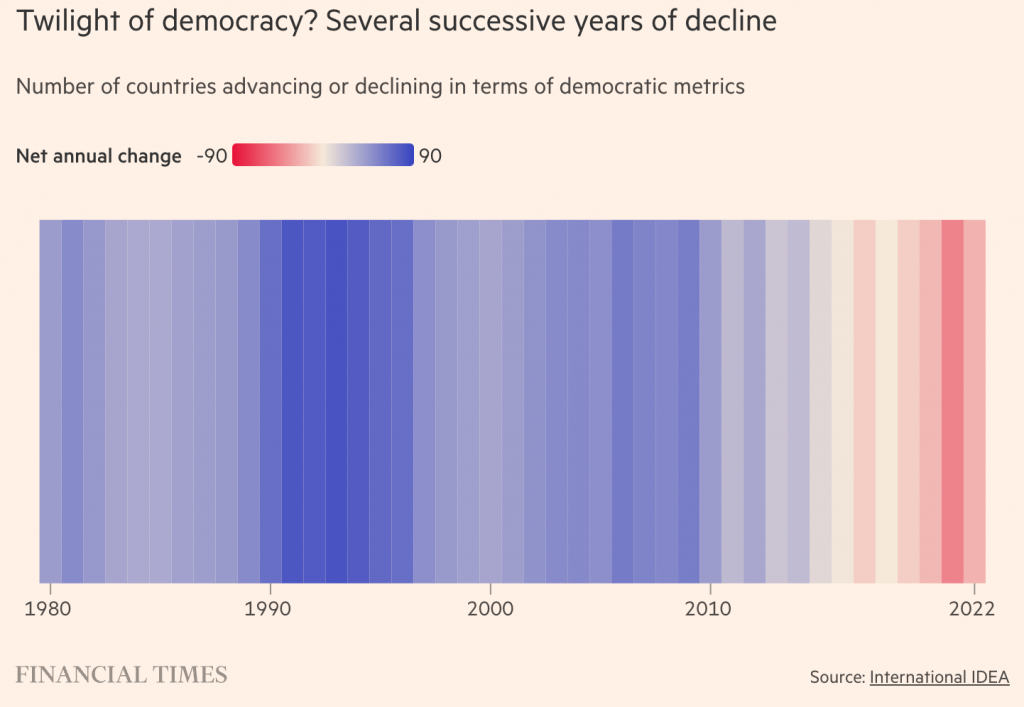

As a side note, seeing stories such as the ‘Twilight of Democracy‘ in the FT could lean into a more UK protectionist attitude to AI, tech and therefore startups. More on-shoring and more focus on owning IP here in the UK would be sensible – and there are Govt programs coming through to better support local markets and innovation – The Mansion House Compact being a great example.

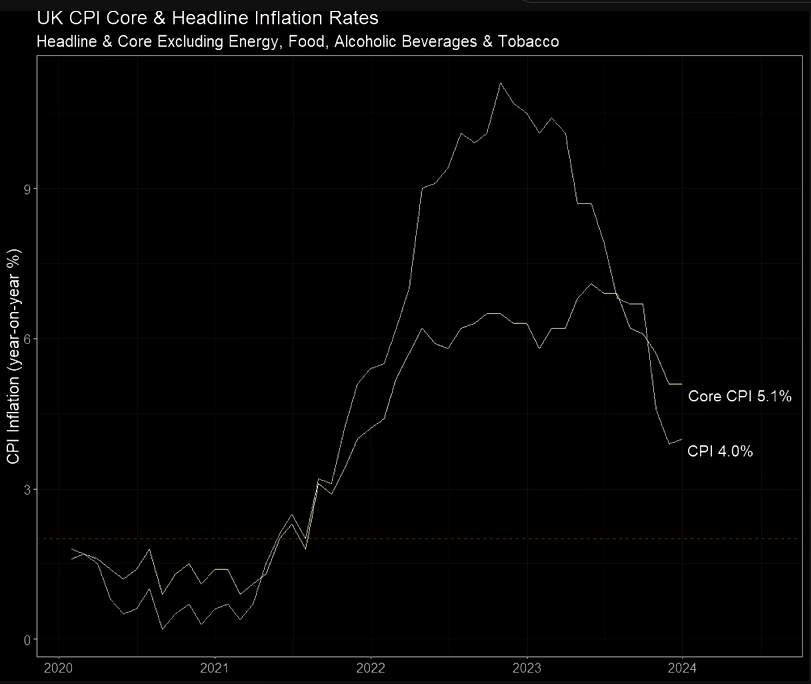

UK inflation is still in the troubled zone with a recent up-tick, albeit small. Driven by services at 6.4% with wage growth as the primary force, but goods inflation has come down significantly to 1.9% – meaning CPI is currently at 4%.

The BoE target of 2% will not be hit until services is tackled, and we all know what that may mean.

A small ray of light is that the rate wage growth is dropping sharply and unemployment has not grown significantly (4.3% which is historically very low).

Across Europe these inflation figures look fairly standard, but compared to the US we’re laggards, as they’re already in the 2% range.

A quick look at UK house prices and retail activity shows two different stories. House prices haven’t collapsed, mainly due to low supply, but they are continuing to slide – London faring the worst with a 6% drop in 2023. On the retail front, activity collapsed in December. Not great when consumer confidence is such an important economic marker.

So how *is* the UK economy doing?

Even though the docket may read doom I’m not convinced, especially within the context of inertia, *and* Europe’s figures. Yes the US has bounced back faster and harder but compared to the EU27 we’re not faring that badly. Unemployment is lower, GDP per capita is 25% higher, and the CEBR predicts that the UK will be the fastest growing major economy over the next 15 years. (i.e. A great time to invest in new tech… just saying).

We must get a stronger handle on inflation (which I believe will happen), therefore interest rates, and therefore a return to more positive economic activity, generally. But it does feel like the UK could make a soft landing, just as the States is already enjoying. We’re just a little behind.

In an election year I’m sure this is welcome news for the incumbents, but let’s revisit this note when Labour and (goodness I hope not) Trump are in power.