Yes – the old year still has a month left. But so much has happened already that it’s timely with a retrospective. Let’s have a look at what’s happened in tech and macro over the past year.

1. The recession that never happened.

Most commentators expected 2023 to be the year of US recession. The US yield curve started inverting in Q4 2022 (meaning the short-term interest rate went higher than the 10-year rate). By May 2023, the short/long inversion reached the highest level it has seen since 1981. Yield curve inversion has historically been a reliable harbinger of recession. And with the Fed pushing rates high, there was an expectation that the economy would sag.

But the recession never came.

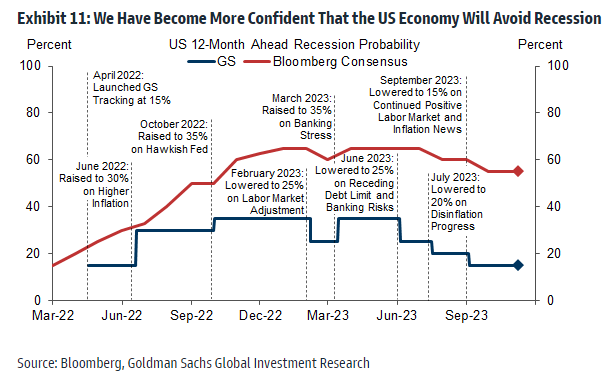

Rather, the US continued to clock up impressive GDP growth, hitting a whopping 5.2% in Q3. We are not necessarily out of the woods. According to Bloomberg, the median forecaster still puts a 50% probability on the US hitting a recession in 2024. But some observers see a much lower probability of a 2024 recession. E.g. Goldman Sachs that now sees only a 15% probability of the down scenario.

2. Tech is back. Sorta.

2022 was a difficult year for tech stocks. Touted as overhyped and overvalued, tech took a beating across the board when rates started to climb.

This changed in 2023, which saw a huge rally in US equities led by the bellwether tech companies. Nasdaq 100 is up 47% YTD and has almost reached its peak from 2021.

It looks like tech is back. At least big tech.

But the wider tech market is still below the dizzying heights. EMCLOUD is 50% below the 2021 top. And later-stage venture capital valuations are still slumping. Venture has been recovering in 2023, but we are nowhere near the froth of 2021/2022. And in fairness, we are grateful for that.

Seed and early-stage venture is alive and well. And there are signs that 2024 could be a big year in technology (more on that below).

3. The wider equity markets have started to come to life

While growth in the S&P500 looked great (up 16% by June), most of the gains had come from the magnificent seven (Apple, Alphabet/Google, Meta/Facebook, Microsoft, Amazon, NVIDIA, Tesla, Amazon). But there are now signs that the rally is starting to broaden.

Could this be the beginning of a wider rally?

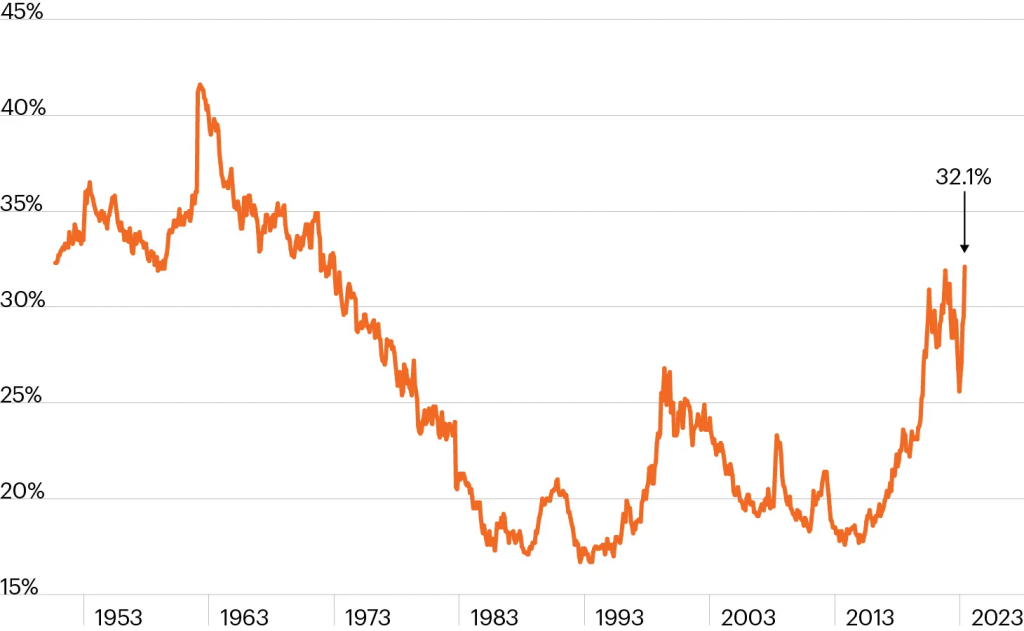

The top 10 stocks (most of which are tech) now account for 1/3 of the total S&P500. That’s the highest proportion since the early 1970s. It feels a bit lopsided.

Big tech valuations are still not frothy, but tech is starting to look a little expensive. And for the S&P500 to keep climbing, the top 10 stocks have to keep growing (or at least not go backwards). So, while there are green shoots in equities, a lot will depend on the Fed’s continued balancing act. The question is: can they keep containing inflation without pushing the economy into a recession?

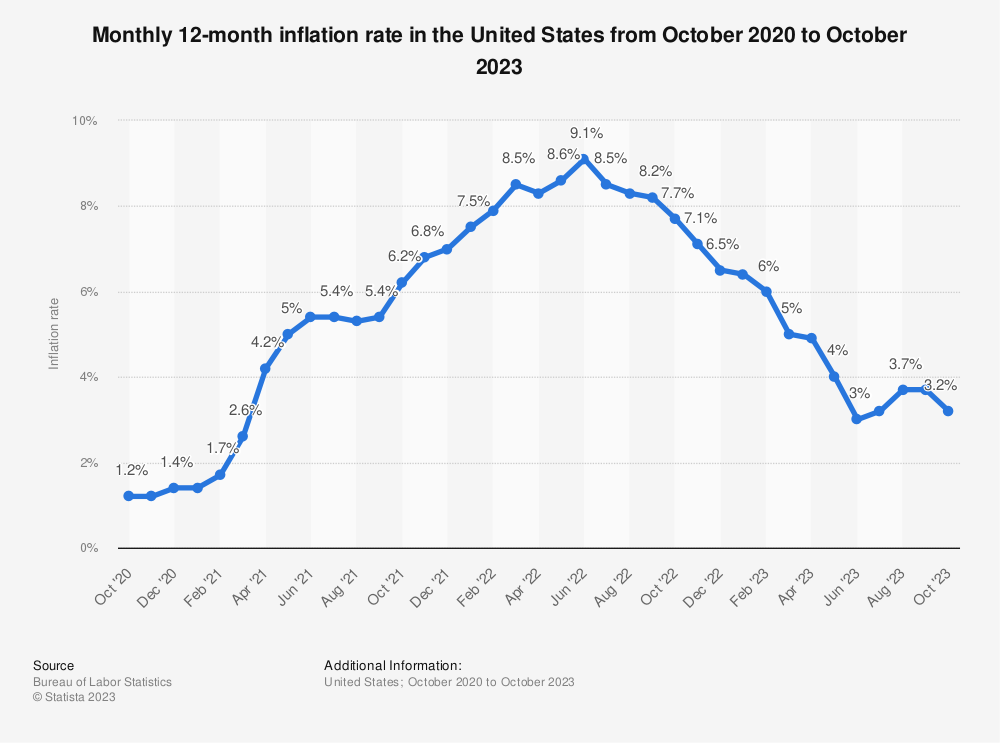

4. Inflation coming under control

The US inflation rate slowed to 3.2% in October, and it looks like the Fed has largely succeeded in containing the inflation monster.

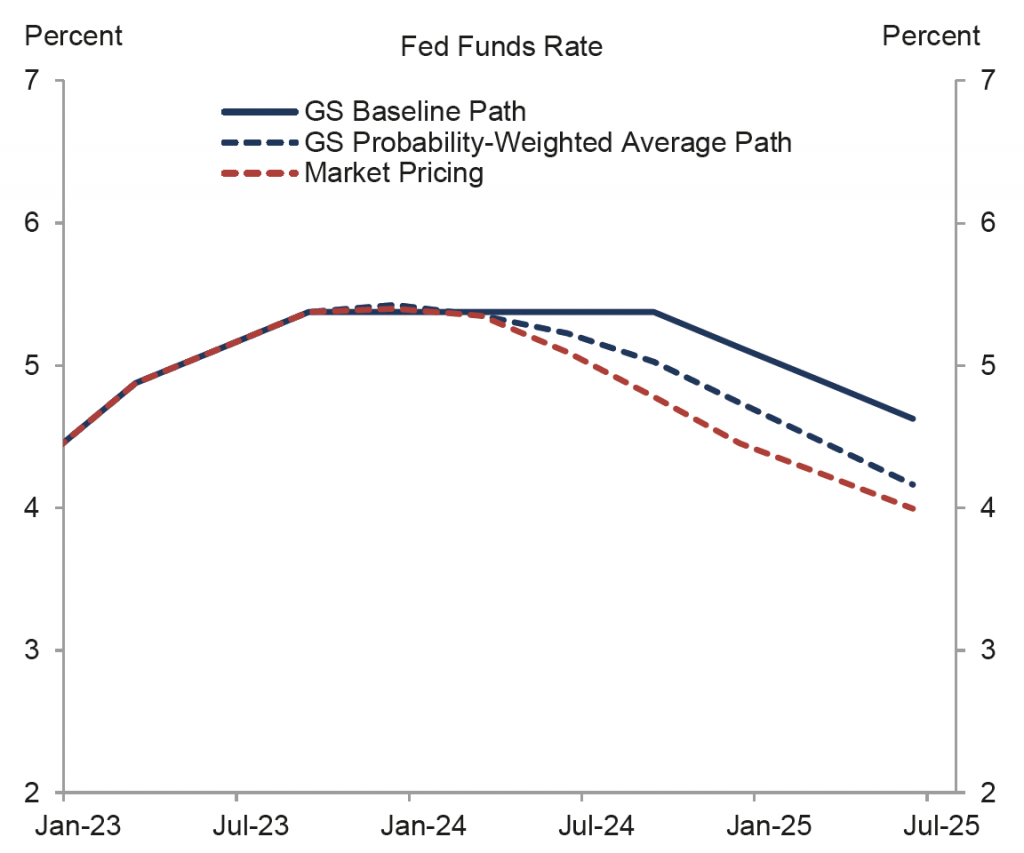

Interest rates are still high, but expectations are that these have peaked. Although they won’t decline immediately, markets expect that they will start to come down in 2024. This is good for stocks, and especially for tech.

5. Growth is back in vogue

For a brief spell, cash flow efficiency and The Rule of 40 were the main valuation drivers of cloud/SaaS companies. (The Rule of 40 says that the Free Cash Flow % + the Revenue Growth rate should be at 40% or better). The Rule of 40 is still correlated with the valuation of SaaS companies (0.59 vs forward revenue). But growth is now nearly as correlated (0.57 vs forward revenue). This means that Free Cash Flow has much less influence on cloud company valuations. In other words, growth is back to being the main driver of public software company valuations. It turns out growth is still valuable – even when interest rates are at 5%.

6. AI is the only game in town

Forget crypto. Forget Web3. And definitely forget the Metaverse. OpenAI and ChatGPT inspired founders and investors alike, and generative AI engulfed the startup world. Many of us think this is the biggest tech disruption for decades – at least since the 90s and the Internet. Most of the excitement in 2023 was about foundation models (the underlying generative models – like GPT from OpenAI). We think the next wave of innovation is in applied AI. More on that next month. Wherever you look at tech, 2023 was the year of AI. We see this accelerate in 2024.

7. Relearning old truths

2020/2021 turned the world of business upside down. Valuations? Why worry – as long as you are in the deal. Unit economics? For dinosaurs – just spend more to grow faster. Company governance? What does that even mean?

In 2022/2023, many venture investors have rediscovered that board seats can be important. Not least Microsoft, who saw the CEO of their $13bn investment fired without consultation. For a little while they must have had red ears.

But in the end, Satya Nadella (Microsoft’s CEO) played it well. He navigated things so that the OpenAI team would either join Microsoft or go back to run OpenAI.

Sam Altman is now back at OpenAI. And – going forward – Microsoft will have an observer seat on OpenAI’s board.

8. Elon, Elon Everywhere

It seems that genius can be its own liability. It is hard to dispute the power of Elon’s entrepreneurial drive, given breakthroughs with Tesla and SpaceX. But being CEO of two of this decade’s defining companies isn’t enough. Elon is also playing it at being a media baron with his new-ish toy X/itter. This is when he is not busy getting embroiled in geopolitics in both Ukraine and Israel/Gaza due to his influential Starlink network.

It’s hard to work out how he has time for it all. And it’s difficult to see how he can avoid distraction from all his extracurricular forays. But however one looks at it, he has been a dominating figure in 2023. Hopefully, he’ll manage to spend more time making cars and building rockets in 2024. Which would meant that we can all enjoy a little less Elon in our news-feed, and a little more of his genius in making world-changing technologies.

9. It’s the optimists that change the world

The stock market has predicted nine out of the last five recessions. And economists many more. But while some are busy predicting doom and gloom for the global economy, the entrepreneurs just got on with it. Undaunted by the prognostication of recession, they hunkered down and got to work building products and companies. So, as a final retrospective on 2023, we dedicate the year to the optimists, the builders and the entrepreneurs who move mountains to make it all happen.

We are fortunate to work with many of them every day.

Here is to their continued success in the year ahead!