This piece is commentary and analysis, not investment advice. Always consult your IFA before making investments.

In 1985, Intel made a decision that nearly killed the company: exit memory chips and bet everything on microprocessors. The memory business was Intel’s identity—they’d invented DRAM. But Japanese manufacturers had turned memory into a commodity, and Intel was bleeding. Andy Grove asked Gordon Moore a question that became famous: “If we got kicked out and the board brought in a new CEO, what would he do?” Moore’s answer was immediate: “Get out of memory.” So they fired themselves and did exactly that.

Today, the executives closest to the frontier of AI are constantly asking themselves versions of the same question. What would a rational observer do with the information we have? And increasingly, the answer is: act as if this transformation is real, because it is.

Last year we made eleven predictions. Eight were correct, one partially so, two missed. (The soft landing happened; Bitcoin didn’t hit $150K.) That’s a reasonable hit rate for an exercise that exists primarily to force clear thinking about the year ahead.

Here are eleven predictions for 2026.

The Defining Context: AI Is the Story

Before the predictions, a framing point. AI is not a story for 2026. It continues to be the story—the lens through which almost everything else will be understood.

This isn’t hype. The people building frontier systems are themselves surprised by the pace. When Andrej Karpathy—who co-founded OpenAI—writes that software development has been “completely transformed” and there’s “no going back,” he’s not marketing. He’s reporting. When Jensen Huang says Nvidia is in “insane” demand, he’s describing his order book. When the biggest companies in the world spend $600 billion on AI infrastructure in a single year, they’re making a bet that the people closest to the technology understand something the rest of us are still catching up to.

The transformation has, so far, been concentrated in text-based professions. Developers, lawyers, analysts, writers. The question for 2026 is whether it spreads further—and whether the infrastructure to support it holds up.

With that framing, eleven specific predictions.

1. No AGI—But Extraordinary Specialised Intelligence

Prediction: AGI will not arrive in 2026. What will arrive: remarkable specialised AI that transforms specific domains completely while leaving others largely untouched.

Confidence: 100%

This prediction grounds everything that follows. The AI industry spent 2023–2024 mesmerised by AGI—Artificial General Intelligence, an AI so powerful it outperforms humans across any field. It isn’t coming in 2026. But something just as interesting is happening.

There’s no consensus definition of AGI. OpenAI defines it economically: “AI that outperforms humans at most economically valuable work.” DeepMind proposes a levels framework, from “Emerging” through “Competent” to “Virtuoso.” Yann LeCun at Meta rejects the term entirely, insisting that current approaches—language models predicting text—are fundamentally incapable of general intelligence because they lack internal world models.

The real pattern

LeCun’s critique points to the real pattern. Software development has been completely transformed. The very best developers say the work is unrecognisable from three years ago. But that transformation happened because software development is fundamentally a text-based profession operating in a world of code and documentation. The same is happening to legal research, financial analysis, and content creation. These professions are being transformed because they operate primarily in text.

AGI would require something more: the spatial intelligence and world models needed to understand and manipulate the physical world. A doctor’s diagnostic workflow. An engineer’s design intuition. A craftsman’s physical skill. That’s years away.

What 2026 will bring is continued explosive progress in text-based domains, plus meaningful advances in spatial intelligence and world models. The transformation will deepen where it’s already happening while beginning to spread to adjacent areas. No AGI. But the most powerful specialised intelligences ever built, getting better by the month.

2. AI Agents Reach 14-Hour Task Autonomy

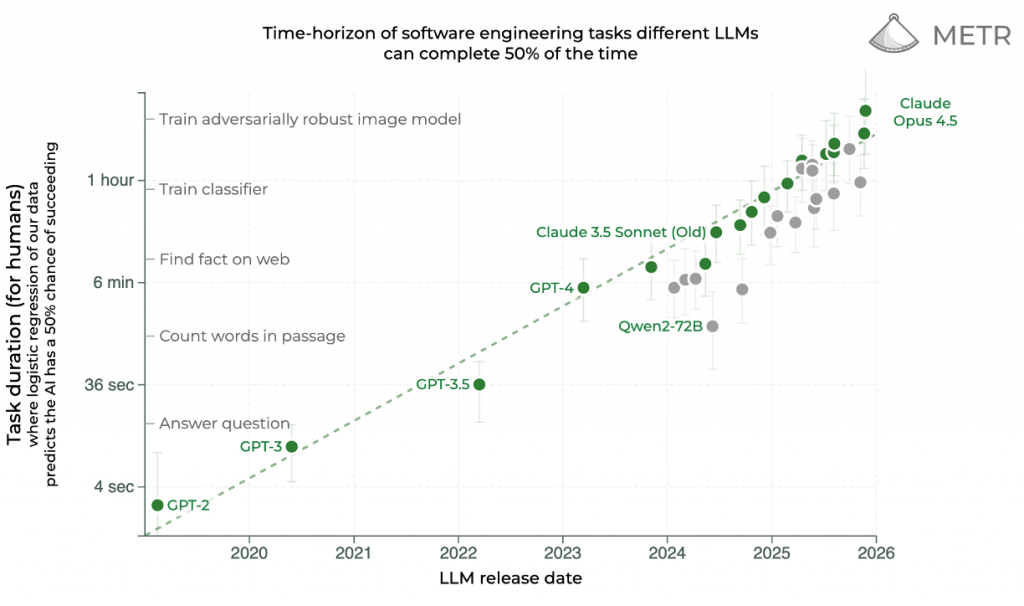

Prediction: Frontier AI models will complete autonomous tasks taking humans approximately 14 hours, at a 50% success rate (METR benchmark), up from 4.8 hours today.

Confidence: 80%

METR tracks how long AI systems can work autonomously before requiring human intervention. In December 2025, Claude Opus 4.5 hit 4.8 hours at a 50% success rate. The capability has been doubling roughly every seven months—and may be accelerating, with some measurements showing doubling every four months in 2024–2025.

Source: METR Research

Extrapolate conservatively and you reach 13–14 hours by end of 2026. That’s a full working day of autonomous operation. The constraint shifts from “can AI do complex tasks?” to “can we verify the work was done correctly?” Oversight becomes the bottleneck.

One important caveat: these benchmarks measure 50% success rates. At 80% reliability—what you’d actually need for production deployment—current models drop to under 30 minutes. But the scope of what can be done with 80% reliability keeps growing at the same pace, if not faster. The explosive evolution is real.

3. The Infrastructure Air Pocket

Prediction: AI CapEx will continue growing, but the gap between spending and returns will become a dominant narrative—an “air pocket” in sentiment rather than investment.

Confidence: 85%

No serious analyst predicts hyperscalers will reduce AI infrastructure spending in 2026. MUFG forecasts total hyperscaler CapEx exceeding $600 billion next year, up 36% from 2025. Goldman Sachs projects $1.15 trillion cumulative spend from 2025–2027. The buildout continues.

But the questions are intensifying. Bank of America’s Savita Subramanian warned in December: “Is this 2000? Are we in a bubble? No. Will AI continue unfettered in leadership? Also, no… investors should get ready for an air pocket.” Hyperscalers issued $121 billion in debt in 2025—four times their historical average—to fund the buildout. This is no longer just an equity story; it’s becoming a debt story.

The maths remain stark. JPMorgan calculates that $650 billion in annual AI revenue is needed to deliver even a 10% return on current investment. Actual AI revenues across all major tech companies total roughly $100 billion. AI datacenters built in 2025 face $40 billion in annual depreciation while generating perhaps $15–20 billion in revenue at current utilisation.

Something has to give—either revenues catch up dramatically, or sentiment cools even as spending continues. We expect the spending to continue. We also expect the mood to sour.

Where the Value Accrues

The infrastructure buildout is real. But where does the value land? Two predictions about where the returns actually show up.

4. Decision Traces Become Critical Infrastructure

Prediction: “Decision traces” emerge as one of the most important new categories in enterprise AI infrastructure—the missing layer that captures not just what AI decided, but why. At least one company in this category will raise a $100M+ round in 2026.

Confidence: 95%

Today, when a sales rep overrides a discount policy, when a finance manager makes an exception to a reconciliation rule, when a support agent escalates outside the standard workflow—that context lives in their heads, in Slack threads, in deal desk conversations. Humans have always been the systems of record for exceptions and precedents. That’s how enterprise software actually runs.

But AI agents don’t have heads. When they start making decisions at scale, enterprises face a new problem: how do you capture the reasoning, not just the output? How do you learn from exceptions? How do you make precedent searchable so the same edge case doesn’t get resolved differently every time?

In the venture industry, we have started framing this as building “systems of record for decisions, not just objects.” The next trillion-dollar platforms won’t be built by adding AI to existing systems of record. They’ll be built by capturing something enterprises have never systematically stored: the “why” behind decisions.

Here’s the deeper insight. AI models are probabilistic—they give you a distribution of possible outputs. But an essential part of the value in enterprise AI comes from the opinionated layer that sits on top: the scaffolding that translates fuzzy probability into reliable action. A raw model might be right 70% of the time. With proper context, guardrails, and decision traces that learn from outcomes, the same model can be right 99% of the time. That’s the difference between an interesting demo and a production system.

We don’t have good tools for this today. That gap becomes critical as AI moves from copilot to autonomous agent. Expect significant investment throughout 2026—including at least one $100M+ round for a company building this infrastructure.

5. Three Major Tech IPOs

Prediction: At least three of SpaceX, Databricks, Canva, Anduril, and Anthropic will complete IPOs in 2026.

Confidence: 70%

The stakes here extend far beyond individual companies. IPO’s have been too rare since 2022. VC distribution yields have fallen to 14-year lows. Limited partners who committed capital expecting regular liquidity have instead watched paper gains accumulate with no path to realisation. The entire venture ecosystem needs these exits.

The numbers are staggering. SpaceX alone is targeting a valuation of as much as $1.5 trillion. Anthropic’s latest secondary pricing implies $350 billion or higher. Databricks sits at $134 billion. If three of these five companies go public, we’re potentially looking at hundreds of billions in VC distributions as early investors finally get liquid.

SpaceX has confirmed IPO intentions; banker conversations are underway. Canva’s largest investor told LPs the company is “ready for H2 2026.” Anduril’s Palmer Luckey has explicitly committed to going public, contingent on the Arsenal–1 manufacturing facility launching in July. Databricks remains IPO-ready. Anthropic has made legal hires consistent with public market preparation.

Individual probabilities range from 45% (Anthropic) to 77% (SpaceX). The probability that at least three of five complete listings is approximately 70%.

The missing name: Stripe. The Collisons have consistently said they’re in no rush.

The Deployment Race

The next four predictions share a common theme: the gap between building something and deploying it at scale. In each case, Chinese operators are moving faster.

6. Waymo Stays Ahead; Tesla Builds Foundation

Prediction: In Western robotaxi markets, Waymo will remain well ahead in 2026. Tesla will progress from tens of deployed vehicles to hundreds, setting up for genuine competition in 2027.

Confidence: 90%

The current gap is stark. Waymo operates 2,500 vehicles across five cities, completing 450,000+ rides weekly—nearly double the figure from six months ago. Tesla has approximately 30 vehicles actually operating in Austin, with 1–5 running simultaneously at any given time.

Tesla’s Cybercab production begins April 2026. Regulatory approvals remain pending—the company hasn’t yet filed for the FMVSS exemption required for steeringless vehicles. The path from tens of vehicles to thousands requires everything to go right for twelve consecutive months.

We expect Tesla to make real progress—moving from current pilot scale to hundreds of operational vehicles by year-end. But 2026 will be foundation-building, not mainstream deployment. The genuine competition arrives in 2027.

7. China Takes 5x Lead in Robotaxi Rides

Prediction: By December 2026, Chinese robotaxi operators (Baidu, WeRide, Pony.ai) will complete 5x more paid autonomous rides than US operators (Waymo) on a monthly basis.

Confidence: 85%

Today the numbers are roughly at parity. Baidu’s Apollo Go completes approximately 250,000 weekly rides; Waymo has pulled ahead to 450,000. But the trajectories diverge sharply.

China operates robotaxis in 22 cities versus 5 in the US. Chinese rides cost $0.35 per mile compared to $2 in America. The regulatory environment is more permissive, the deployment velocity faster, the cost structure fundamentally different. Baidu has already achieved per-vehicle profitability in Wuhan.

This is less a technology gap than a deployment gap. Chinese operators are optimising for scale while American operators optimise for safety margins. Both approaches are rational given their regulatory environments. But the scale difference will become dramatic by year-end.

8. Chinese Open-Source AI Hits 60% of Downloads

Prediction: By December 2026, Chinese developers will account for 60%+ of global open-source AI model downloads (up from 44% today).

Confidence: 80%

Alibaba’s Qwen was downloaded 750 million times in 2025—more than Meta’s Llama. DeepSeek operates under MIT licence. Eight of the top ten performing open-weight models on major benchmarks are now Chinese.

This doesn’t mean closed frontier models are displaced. OpenAI, Anthropic, and Google retain advantages in capability and enterprise relationships. But open-source is following a familiar pattern: good enough for most use cases, radically cheaper, improving rapidly.

The strategic implications are significant. If 60% of the world’s developers are building on Chinese open-source models, that creates a massive installed base. Network effects compound. Documentation, tooling, and community support all favour the models that developers actually use. American frontier labs might retain the capability lead while losing the ecosystem.

9. Humanoid Robots Exceed 50,000 Units

Prediction: Global humanoid robot shipments will exceed 50,000 units in 2026, with China accounting for 75%+ of deployments. The battery constraint will be solved operationally rather than chemically.

Confidence: 90%

In 2025, approximately 18–20,000 humanoid robots shipped globally. Chinese manufacturers—Unitree, UBTech, AgiBot—dominated, with costs 80% below Western competitors.

The battery problem—robots running only 90 minutes to 2 hours on a charge—was supposed to be the blocker. Factory work requires eight-hour shifts; current batteries don’t get close. Waiting for a breakthrough in battery chemistry could take years.

Source: @globaltimesnews – UBTech Walker S2 unveiling, July 2025

But it turns out the problem can be solved with existing technology. UBTech’s Walker S2 autonomously swaps its own battery in three minutes. The robot doesn’t need eight-hour battery life if it can swap packs before running down. This is classic Chinese manufacturing pragmatism: solve the problem that exists with the tools that exist, rather than waiting for the perfect solution. Expect rapid scaling in factory deployments throughout 2026.

Europe’s Reckoning

Europe spent years positioning itself as the alternative to American and Chinese tech—more regulated, more ethical, more balanced. That positioning is colliding with economic reality.

10. Europe’s Tariff Awakening

Prediction: The EU will announce new or expanded tariffs on Chinese goods beyond current EV tariffs in 2026.

Confidence: 85%

The rhetoric has escalated. Macron warns that Europeans will be “forced to take strong measures in the coming months” and explicitly called for Europe to “decouple, like the US.” The EU’s trade deficit with China reached €284 billion. Current EV tariffs of 17–45% are failing—Chinese brands doubled their European market share in 2025 despite the duties.

And now comes the “second China shock”: US tariffs redirecting Chinese goods toward Europe. European manufacturers face competition on two fronts.

The biggest camel European leaders have to swallow is this: Trump may have been right about something. Europeans have spent years criticising American tariffs as crude protectionism. Now they’re moving toward the same policies—while insisting their approach is fundamentally different. Macron can say Europe needs to “decouple like the US” in one breath and criticise American trade policy in the next. The cognitive dissonance is striking, but the direction is clear.

Admitting that someone you dislike might have had a point is never comfortable. But economic reality has a way of overriding ideological preferences. Expect expanded tariffs in 2026.

11. EU AI Act Provisions Further Delayed or Diluted

Prediction: The EU AI Act’s high-risk provisions will be significantly delayed beyond the original August 2026 timeline, with further dilution likely throughout the year.

Confidence: 90%

The shift is already underway. In July 2025, over 60 European companies—including ASML, SAP, Mistral, Mercedes-Benz, and Siemens—signed an open letter calling for a “clock-stop” on AI Act implementation. By November, the Commission had capitulated. The Digital Omnibus package delays high-risk provisions from August 2026 to December 2027, with further exemptions likely.

The rhetoric has shifted entirely. Draghi’s competitiveness report called for implementation to be “paused.” Von der Leyen promised to “cut red tape” and simplify regulations. Macron called for the Commission to “simplify the rulebook.” The “regulate first” instinct that produced the AI Act is giving way to competitive panic as European AI companies fall further behind.

This isn’t just about dates. The Act that eventually takes effect will be materially weaker than what was passed. The original vision—Europe as the global standard-setter for AI regulation—is quietly being abandoned. The question for 2026 is how much further the retreat goes.

The Pattern

Three themes run through these predictions.

First, deployment trumps capability. The interesting gaps aren’t between what AI can do and what it can’t—they’re between what works in demos and what works in production, between what’s been built and what’s been deployed, between American capability development and Chinese deployment velocity.

Second, sentiment and reality diverge. AI spending will continue while AI sentiment might selectively sour. Europe will resist tariffs ideologically while implementing them practically.

Third, China keeps surprising. Robotaxis, open-source models, humanoid robots—in each case, Chinese operators are deploying at scales that Western observers underestimate. DeepSeek was supposed to be impossible. The pattern continues.

In 1985, Intel’s decision to exit memory looked like retreat. By 1995, it looked like genius. The company that abandoned its identity became orders of magnitude more valuable than any memory manufacturer.

But here’s the twist. In 2025, memory has become the strategic chokepoint of the AI era. High Bandwidth Memory (HBM)—the specialised chips that feed data to AI processors—is in such short supply that it constrains the entire industry. SK Hynix, which dominates HBM with 62% market share, has its entire production sold out through 2026. The “commodity” business Grove fled now commands the margins Intel abandoned, and Intel finds itself offering to package other companies’ HBM rather than making its own.

Grove’s decision was right for 1985 but contained an implicit bet: that memory would never be strategic again. That bet just lost.

The question for 2026 is similar. What would a rational observer do with the information available? The answer, increasingly, is to act as if the AI transformation is real and accelerating—because the people closest to it are doing exactly that. But also: to pay attention to which bets are implicit in that view, and what would happen if they turned out to be wrong.

We’re one day and eleven predictions into 2026. Check back in December.

How Did We Do for 2025? 8 out of 11 hits. Read more here.

What are your predictions for 2026? Please get in touch to share – we’d love to hear them.