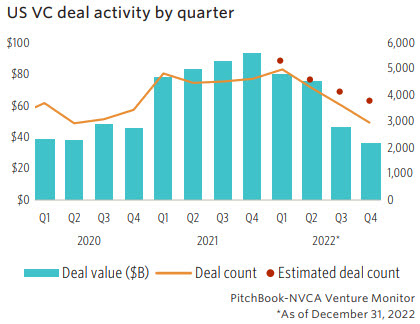

Pitchbook’s preliminary Q4 numbers for US Venture Capital activity are now out. They show last quarter’s investment activity (measured in number of deals) down by 25% from Q1. But they also show activity higher than any other quarter in the past ten years.

All Q4 investment rounds have not yet been announced. So the preliminary figures adjust for this by estimating completed but as-of-yet unannounced deals.

A few observations:

- The analysis shows that numbers have declined. But anecdotally, most people I speak with feel that the decline has been much more severe than 25%.

- This is possibly because Pitchbook overestimates Q4 activity.

- More likely, it is because most of the new rounds are “internal” – i.e. companies raising from existing investors.

- If most folks are raising internally, the market will feel much quieter.

Why does this market feel difficult for founders (and some investors?)

Venture Capital is the definitive “growth” industry. It’s wired to grow all the time. Even a static market will feel tough, and a declining one doubly so.