Why are early-stage valuations going up?

Growth stage valuations have collapsed this year. Like public market tech investors, private growth-stage investors have taken a bath. Earlier this year, Klarna raised money at an 85% lower price than its 2021 valuation. Ouch.

But what’s going on at the early stages?

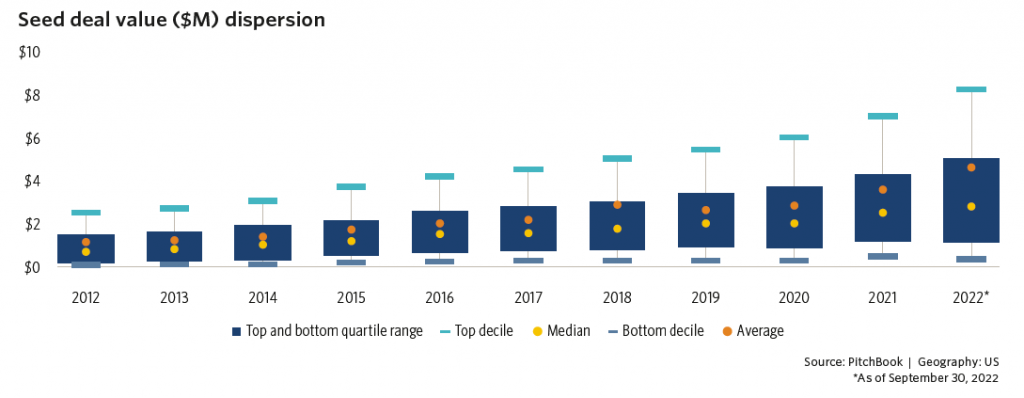

On Friday, Pitchbook released the 2023 US Venture Capital Outlook. Far from decreasing, it shows US Seed valuations going up in 2022.

Given the macroeconomic backdrop, this seems counterintuitive.

But there is a simple explanation. The main driver has been a flight to quality:

- the bar has gone up. Fewer deals are getting done, and only the best companies are getting funded.

- the best companies, on average, raise more money than the median performer.

- as only the best companies are raising, the median US valuation and round size is going up.

- this is further compounded by the bigger firms doing more seed deals. Accel, Andressen, Lightspeed, Sequoia etc have been more active in US Seed in 2022. And they tend to write bigger cheques.

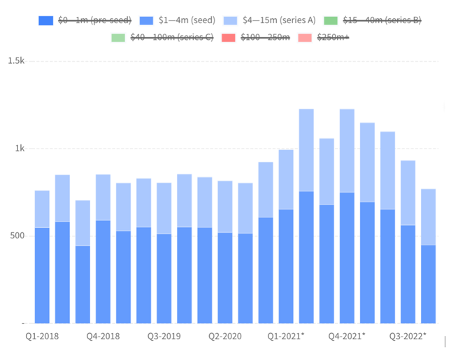

So fewer and bigger firms writing fewer and bigger cheques. That’s the story of US venture capital so far in 2022.

How are things looking in Europe?

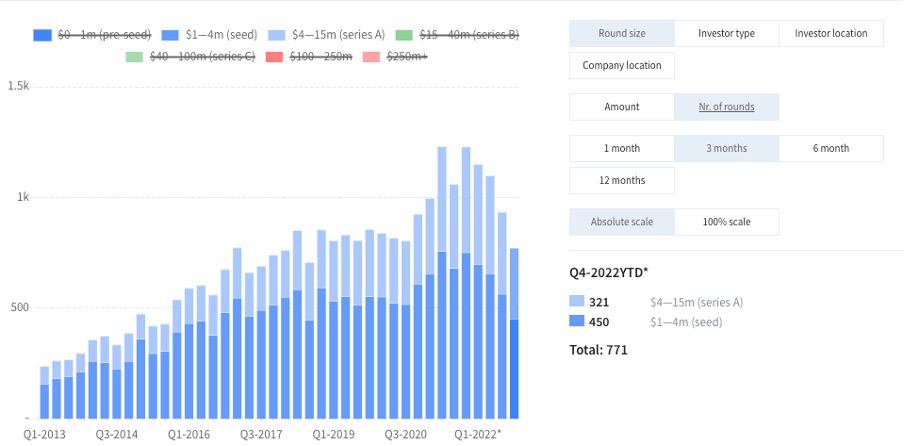

According to Dealroom data, European Seed and Series A round sizes were stable between Q4 ’21 and Q3 ’22. ~$2.2m for the typical Seed and ~$7.9m for the typical Series A.

But volumes are off by 20%, down from 1,150 investments in Q4 of last year to 934 in Q3 of this year. The expectation is that the number will decline further in Q4. Even adjusting for the usual lag in the data, the data matches what we see on the ground. Fewer deals are getting done.

Let’s assume a similar pattern to the US – i.e. that only the best investments get made. This means that the average investment in Q3 of this year was into a higher-quality opportunity (traction, risk, team etc). And if the average investment is of higher quality, and the average price is the same – well – that’s a relative price cut.

So although it looks like valuations have continued to increase at the earliest stages, the reality on the ground is more mixed.

This is a tough time for founders. Most have had to adjust their plans in light of the funding market. But ultimately, we see much better businesses being built. More judicious spending and better unit economics. And I expect that the near-term pain felt by entrepreneurs will translate into better long-term outcomes for all.

Founders as well as investors.