As 2022 draws to a close, I’d like to reflect on the year we’ve had, the global economy, and what is ahead for 2023.

The Pandemic and the War in Ukraine have disrupted the global economy and bookended an era, but also laid the ground for growth opportunities in the decade ahead.

I’ll get to the growth opportunities in a minute. But first, let’s take a look at how we got here.

Let’s think back to the start of the year. War in Europe wasn’t on most people’s bingo cards. And it’s easy to think of the Russian invasion of Ukraine as the key driver of this year’s misery for investors. The breakout of war was a shock to the system. But the seeds had already been sown.

Globalisation has been driving the global economy for the last four decades. The seventies had been marred by stagflation. Following the oil crisis of the early seventies, spiking energy prices and inflexible labour markets led to a wage-price spiral. The result: moribund economies and high unemployment. Let’s review what has happened since then.

Four Decades of cheap labour, cheap energy and cheap money.

Globalisation provided a steady stream of cheap labour. It kept the cost of imported manufactured goods down and kept western labour costs in check. The result: low inflation.

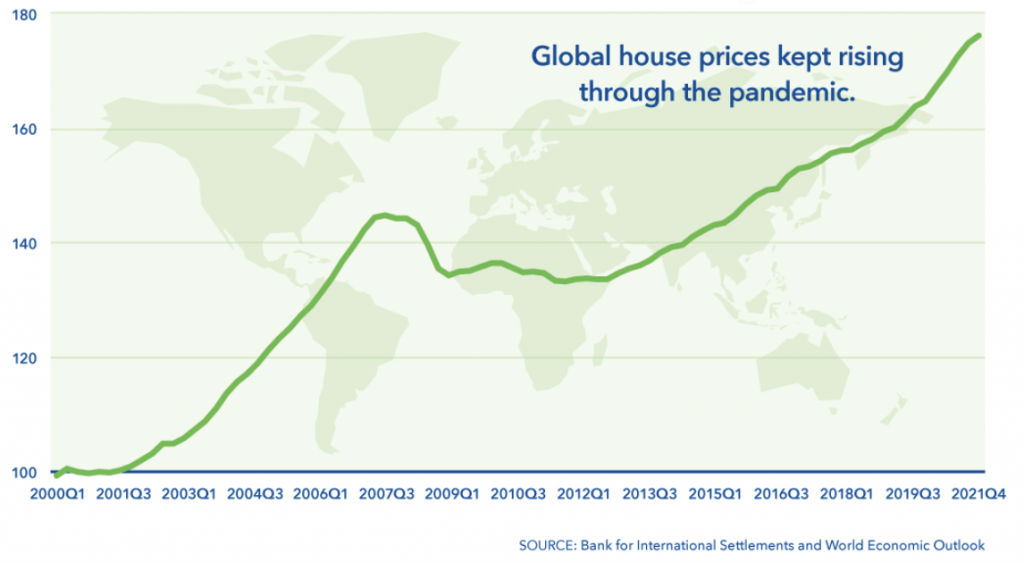

As inflation stayed low, central banks could keep interest rates low. Cheap credit fuelled rising asset prices – especially for housing. But also for company stocks – both public and private.

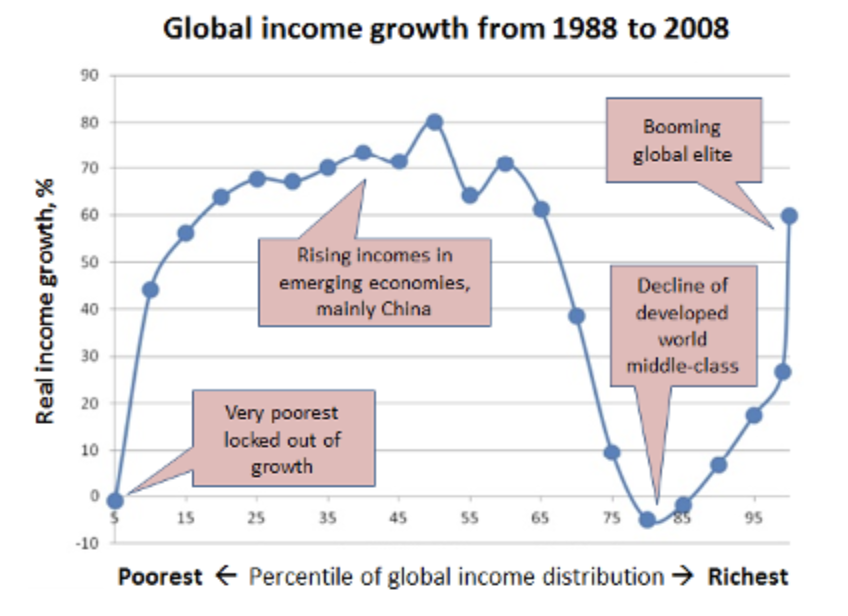

Globalisation created a global economic boom. It lifted hundreds of millions out of poverty in the East and helped the richest in the West amass vast wealth.

This wealth was not evenly distributed. Many in the Western middle class were left behind, leading to protests at the ballot box. This disrupted the post cold war political stability and led to the rise of autocrats from North to South. The end of history and the triumph of liberalism were cancelled (or at least temporarily put on hold), and we still feel the aftermath of these shocks to the political system.

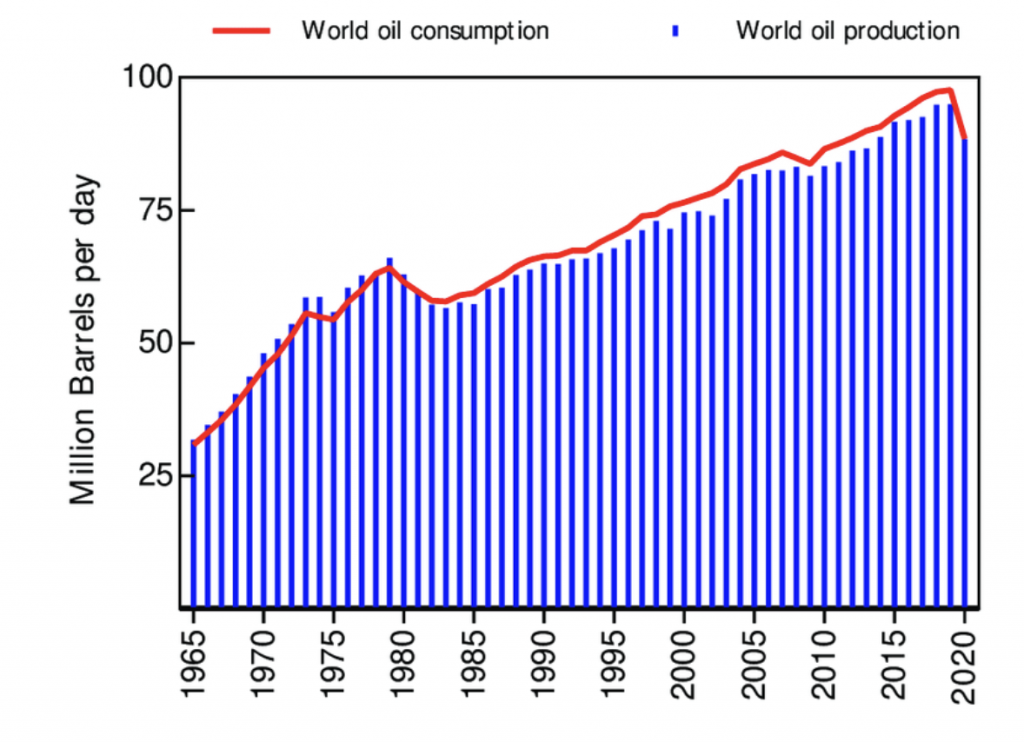

At the same time, vast global economic growth was sustained by abundant cheap energy. We became so efficient at extracting energy that oil and gas prices stayed low in the 80s and 90s, despite rampant consumption.

By the noughties, oil prices started spiking, leading to moderate inflation in the US. However, this was soon subdued by the Great Financial Crisis and more or less kept in check until Russia invaded Ukraine at the start of 2022.

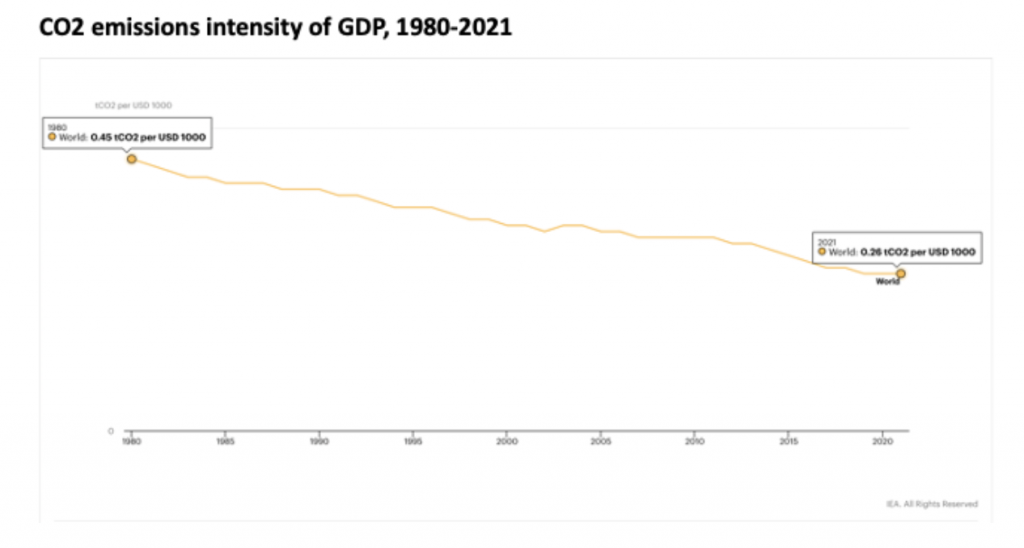

We can see more efficient use of oil and better use of renewables when we measure the CO2 emissions per $ of GDP.

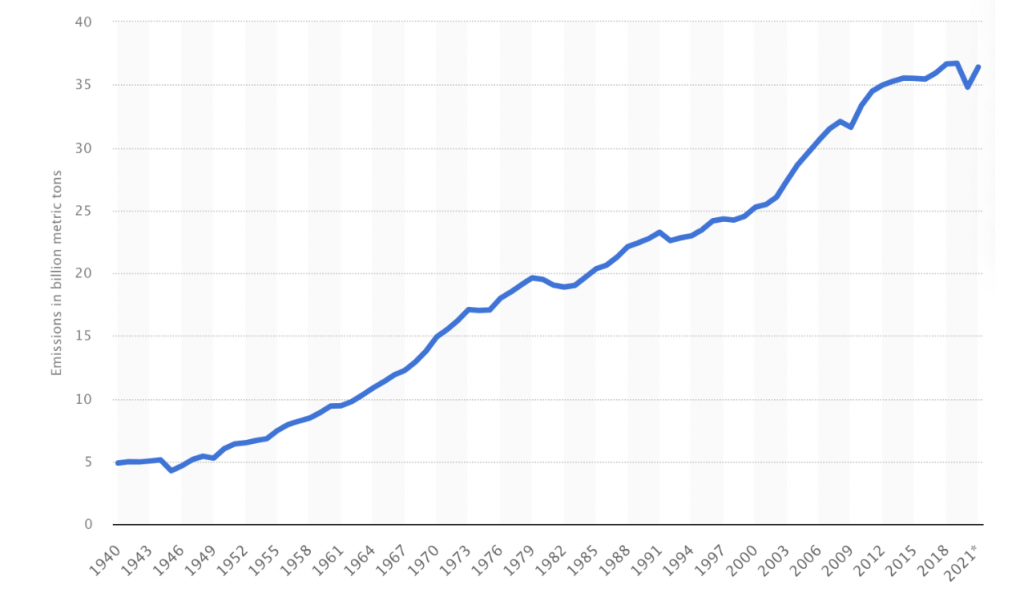

However, because global economic activity has increased so much, emissions have kept going up, up and up.

So when viewed from the West, these were the defining three features of the past four decades:

1. Cheap manufacturing abroad and depressed wages at home

2. Cheap energy and increasing emissions

3. Cheap credit and inflating asset prices

These trends have now come to an end. This will lead to the most significant shift in our global operating model in our lifetime.

Globalisation – the next chapter

We see three tectonic shifts in the global economy.

1. Changing the way we make and move things

Two factors are upending the way we manufacture goods, with knockon effects for supply chains and logistics:

- Traditional offshoring to China is coming to an end; and

- The Pandemic and war are exposing the brittleness of supply chains.

Let’s unpack these further…

The end of traditional offshoring

The era of offshoring and simple labour arbitrage is over.

Offshoring and labour cost arbitrage were key drivers of “operating efficiency” for decades. But China hit the “Lewis turning point” during the last decade, and the country now faces decades of a declining working-age population. This means that a near-unlimited supply of workers has come to an end. The cost of labour has already been increasing over the past two decades. This is set to accelerate further.

A bifurcation of the global economy

We are starting to see a decoupling between China and the OECD.

During the nineties and the noughties, tighter economic integration between East and West was a key part of the Western playbook. As developing countries became more prosperous and more integrated into the global economy, they would naturally transition towards western liberal democracies. That was the way things were “supposed to work”. But emerging economies refused to follow the script. Emerging BRIC economies weren’t interested in simply aligning with the priorities of the West. Many policymakers in both Europe and the US were quite late to decipher China’s geopolitical ambition. But when Russia invaded Ukraine at the start of 2022, everyone finally understood the need for a new playbook.

As Chinese labour costs have risen and political winds have shifted, manufacturers are now looking at rerouting manufacturing to “friendlier” nations. Or perhaps bringing it home entirely. For concrete examples, see the US CHIPS Act that aims to cut China off from advanced, Western semiconductor technology.

Companies will keep looking for ways to lower costs to maintain and expand profit margins. And with cheap Chinese labour giving way to more expensive alternatives, those alternatives must be augmented by automation and technology. This is the first major driver of B2B technology investment over the coming decade.

2. Transition to the low carbon economy

We need a new playbook to deliver “net zero”.

The growth in carbon emissions has been rampant over the past four decades. We have a target to bring emissions to net zero by 2050 – just 27 years away. Barring a global calamity that eclipses the Pandemic, it is a safe bet that this won’t happen through the curtailment of human economic activity. It is in our human nature to make, to travel and to do. So we must find ways to keep increasing economic activity while eliminating our oil addiction.

To deliver on the promise of net zero, we need to radically retool the way we make and the way we move: new ways to make things and new ways to generate, store, and transport energy, people, and goods. These are enabled by massive investments in technology and infrastructure.

The transition to net zero will drive business investment in two ways:

- Firstly, because business will be critical in developing, manufacturing, installing and operating the decarbonised economy. There is a huge economic opportunity in this.

- Secondly, because the cheapest megawatt is the one we never need to generate. And there are still massive efficiency opportunities in manufacturing and transportation through investment in better technology. With the intelligent use of tech, every company can make more with less.

I predict a wave of investment into improving both the supply and demand sides of the global energy marketplace. And, of course, much of this will continue to be through traditional interventions (leaky houses and inefficient means of transportation still waste a lot of energy). Still, there are nearly limitless ways to make factories and offices more efficient, enabling us to make and do more while consuming reduced resources.

The transition to the low carbon economy is the second major driver of investment in the coming decade.

3. The end of “dumb money”

For forty years, investors have had a relatively easy ride. And especially the decade and a bit since the Great Financial Crisis have been straightforward. With low interest rates and quantitative easing, all assets have inflated. Stocks and bonds. Of course. But also property. And art. And wine. And cars, watches and pretty much everything else you could invest in.

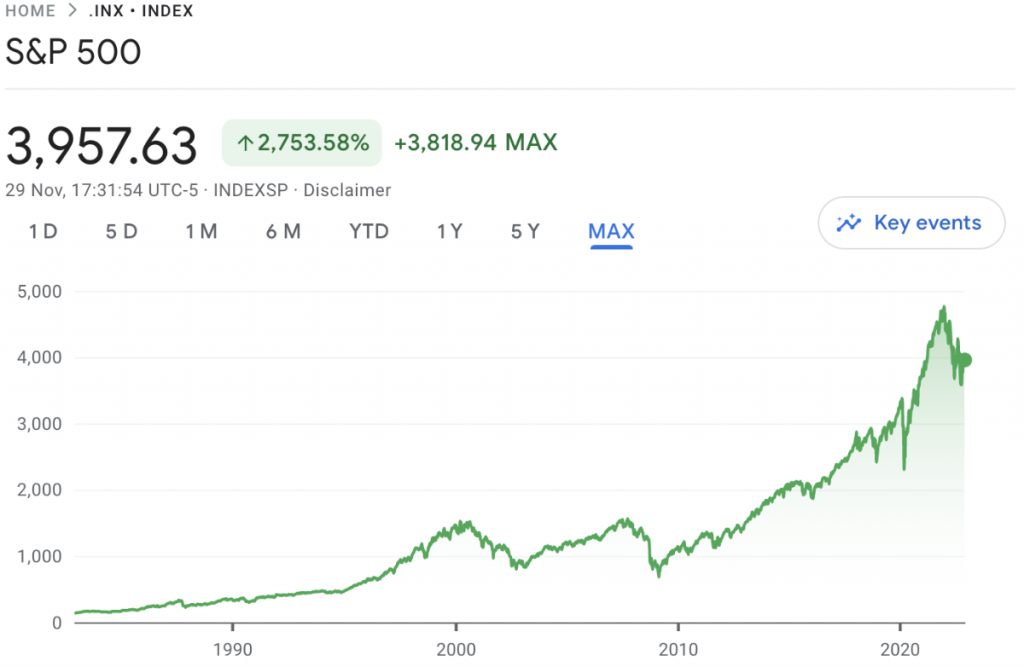

Over the last decade, stock market investors have reaped 11-12% a year after inflation.

A few technology companies with incredible business models drove a big part of the increase. However, with both bellwethers Alphabet and Apple reporting declining EPS over the past year, investors are out of safe havens.

So as investments go, it is time for all of us to be smarter. Of course, the S&P500 will likely still be a good investment over time. But it is unlikely that passive capital allocation will perform as well over the next decade as it did during the era of QE.

Instead, savvy investors will look for opportunities that create tangible returns for customers. If the “greater fool” theory of investment no longer works, investing becomes about identifying and picking investments that create tangible ROI for business customers – either as growing top line or efficiency gains.

A new paradigm for the global economy

In summary, we see the global business paradigm migrate from:

- dogmatic offshoring and low-wage arbitrage to a much more sophisticated supply chain strategy (this necessitates more investment in automation and other enabling technologies);

- a high carbon to a low carbon economy (this will again necessitate investment in automation and other efficiency-enhancing technologies); and from

- asset inflation and “the tide lifting all boats” to a climate that requires more thought to pick the best investments.

All of this speaks to more investment in technology that makes business smarter and more efficient. And at the heart of this sits AI-powered software.

Investment opportunities in Make, Move and Manage

We see great opportunities emerge in the three verticals of Make, Move and Manage:

- Make – Next-generation industrial automation (Industry 4.0) combining IoT, AI and edge computing to make our manufacturing processes much more efficient;

- Move – next-generation logistics and supply chain management that drives better forecasting and demand planning and a more flexible and resilient supply chain; and

- Manage – next-generation enterprise software that empowers businesses with the latest advances in AI to optimise effectiveness and employee productivity.

The coming 6-18 months will likely be choppy “in the real economy”, which will impact both consumption and investment. But I don’t think it will take too long to get inflation and interest rates under control. And this will unlock the next wave of investment in technology that will lay the foundation for a prosperous decade ahead.

As humanity, we have significant challenges ahead of us. But this is precisely the type of environment that makes human ingenuity thrive. The easy options are gone. Now we have to do the hard work. And by pursuing that road, we will unlock a decade of creativity and growth ahead.

Bring on the roaring 20s of the new century!