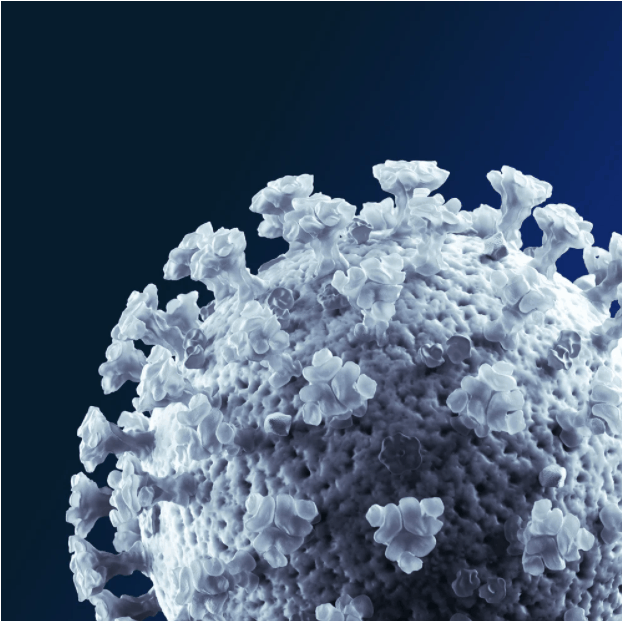

We are now well into what’s starting to feel like a “new normal” in the “lockdown economy”. Other than the challenges of juggling home-schooling with investment work, our team has not been significantly impacted as everyone has quickly adjusted to remote working.

For the wider economy as well as for many individuals the Covid pandemic has been devastating. However, from a seed investment perspective we have seen a 2-3x increase in dealflow at more attractive valuations, so in some respects there is a silver lining to the situation.

What does this mean for venture investing?

Many of us have had a feeling that we were drowning in analyses discussing “what this means”, and it does feel like many observers are trying to read the tea leaves and come up with insights that are more or less well baked. The truth is – we may not know yet. In the recent words of legendary investor Howard Marks: “it’s my view that if you’re experiencing something that has never been seen before, you simply can’t say you know how it’ll turn out”. At least in the longer run.

In the short run, we still have relatively limited data, but anecdotally the trend seems to be that we are shifting to more of an investors market in early stage venture investing.

Here are a few recent analysis that we think merit reading:

- McKinsey on the “next normal”

- Analysis on the implications for Private Equity in general (more buy-out focused, but with some parallels to venture)

- Analysis from Tom Tunguz showing a sharp contraction in round sizes – particularly at Seed stage. This will have implications for valuations.

- And finally, Howard Marks’ most recent investment memo.

From a SuperSeed perspective, we keep pushing forward as we are seeing exciting companies raising at reasonable valuations. If you’d like to discuss opportunities or the markets in general, please don’t hesitate to reach out.

All the best,

Dan, Mads and the SuperSeed team.