On June 8th, the S&P500 (an index of 500 large publicly listed US companies) reached 3,232, very close to the previous all time high of 3,386 from February 19th. In the days since then we have seen market gyrations, but these notwithstanding, the rebound since March 23rd when the market plunged to 2,237 is on the back of US unemployment hitting 40m. With the number of unemployed in the US now at the highest rate since the Great Depression and markets close to an all time high, what’s going on?

At the face of it, it seems like there is a disconnect between the stock market and the “real economy”. And if you have a business or work in the travel or leisure sector, you probably don’t feel the economy is even remotely close to being back to where it was. So why are stock markets doing so well?

- Company valuations are tied to future expected cash flows. The value of a business is much less about what happens today, and much more about what might happen in the future. As long as investors expect companies to do well in the next 3 years+, there is a view that some short-term choppiness in earnings is manageable.

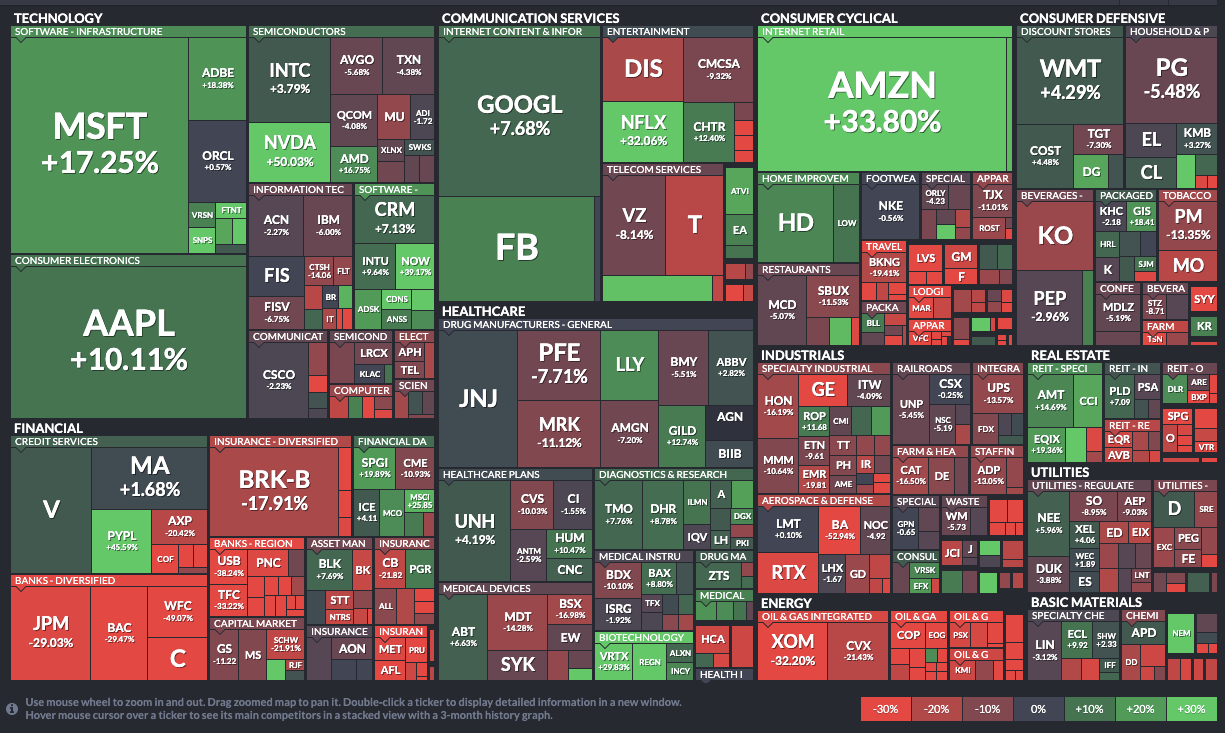

- Asymmetric recovery. When looking at S&P500 – almost 20% of the value is determined by just 5 companies – Microsoft, Apple, Google, Facebook and Amazon. Their market cap is so large, and their performance has been so strong during the crisis, that they just in themselves have made up the bulk of the gains from the index (see chart below.

- Government intervention. Governments have acted much more swiftly this time round than was the case previously. During the Financial Crisis of 2007-2009, it took more than a year until the $~800m American Reinvestment and Recovery Act (ARRA) was passed on February 17th, 2009, more than 15 months after the crisis had started. Conversely, this time round, US congress passed a $2.2trn stimulus bill on March 25th, just a few months after the crisis began. This is a massive difference in speed which has had an immediate impact on stock markets.

So what are the takeaways? For now, governments are propping up the economy, and markets believe that this is a credible strategy – at least for the largest and most successful tech companies.

However, when it comes to the real economy, the picture is much more nuanced. It’s obvious that for millions of people, we are nowhere near “back to normal”, and the repercussions could take a long time to percolate through the economy.

What does this mean for venture investing?

As seed investors, we are always trying to work out what might be the successful technologies and companies of tomorrow, and so we have a built-in bias towards the long-term rather than the here and now (see point 1 above). This means that our macro-strategy remains unchanged – we are still looking for companies that have the potential to disrupt industries in the future, and judging from the many highly innovative businesses we see, the future has lots of positive technology disruption in store.

On a tactical level, we continue to work with our portfolio companies to help them remain well capitalised and run in a capital efficient way, as customer sales cycles can be impacted and new fundraising rounds can take longer. And for new investments, we work with founders to help them build extra runway into their raises, so they have extra reserves to get to the next milestones – even if the next 1-2 years will be more challenging from a business climate perspective.

And finally, we keep investing in innovation that provides real ROI for customers. Whether good times or bad times, businesses are always looking for technology that can deliver real return on investment. And that is the type of technology we invest in at SuperSeed.

We’ll close this update with a few parting words from General Stanley McChrystal (now retired) who has led forces in both Iraq and Afghanistan. He is very used to dealing with crises, and was recently interviewed by Reid Hoffman (co-Founder of LinkedIn) on the Masters of Scale podcast. It is well worth a listen.

“as soon as it [the economy] starts to sort itself out, certain organisations are going to sprint ahead because they have been figuring it out and they’ve been going to school on this”

Find it here or on your favourite podcast app.

All the best, Dan, Mads and the SuperSeed team.