Why Anthropic Commands $170 Billion as Alibaba’s Open Source reaches parity

This is not investment advice. Always consult your IFA before making investments.

On December 26th last year, Western investors were busy enjoying Christmas food while a Chinese start-up released an open-source model that approached the state of the art of Western frontier AI models. At a fraction of the cost. Markets didn’t pay DeepSeek v3 any attention at the time. Then came January: DeepSeek R1, their reasoning model, triggered a $600 billion stock market wipeout. The lesson seemed learned.

Yet here we are in July, just seven months later: Chinese AI startup Moonshot launches Kimi K2. An excellent open source model on par with those from US frontier labs OpenAI, Anthropic, Google and xAI. Less than a week later, Alibaba releases an upgrade to their open source model – Qwen3. This model was even better! As we enter August, Anthropic looks to raise $5bn at a $170bn valuation. But in the background, Alibaba’s model performs on par with Anthropic, at $0.22 per million tokens—1/68th of Anthropic’s price. The pattern holds: ignore until forced to see.

Stocks Back at an All Time High

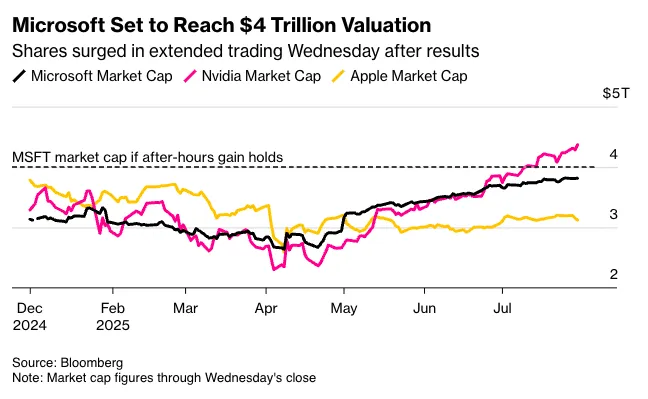

The S&P 500 gained 2.3% to close at 6,339, bringing year-to-date returns to 8%. This week added fuel: Meta’s quarterly profit reached $18.3 billion (beating expectations by 21%), Microsoft’s AI business hit a $13 billion run rate (up 175% YoY), and Q2 GDP surprised at 3.0% versus 2.3% forecast. Broader market participation continues beyond tech giants. The Fed held at 4.50% while inflation ticked up from 2.8% to 2.9%—driven by exactly the import categories economists warned about when evaluating tariff impact. Markets have powered ahead anyway. After all, 15% EU tariffs beat the threatened 30%.

The rally obscures deeper shifts. Core goods inflation stirred to life at 0.2%, led by clothing and appliances. Without auto price declines masking impact, the rise would’ve been 0.5%—the highest monthly jump since 2022. The bond market at 4.37% indicates what politicians won’t say: tariff passthrough has begun.

But so far, markets are shrugging that off, as Microsoft becomes the world’s second $4trn company.

The AI Acceleration

Anthropic’s trajectory defies precedent. Revenue exploded from $1bn to $4bn in half a year—perhaps the fastest growth in startup history. Their models are exceptional and their execution brilliant. They’ve captured the mind-share of the world’s software developers. Assuming the company will be at $5-6bn of run-rate revenue by the time a new $5bn round closes, this would value the company at 28-34x ARR. Doesn’t feel completely out of kilter for a company that is on track to grow from $1bn to $10bn in a year. But how can Anthropic’s Dario Amodei grow revenue so fast, if comparable Chinese open source models cost a fraction of the price? It turns out he has built something Fortune 500 CTOs want to buy: compliance guarantees, US data residence, enterprise SLAs, and someone to sue if things go wrong.

Yet Alibaba’s July model (enticingly named Qwen3-Coder-480B-A35B-Instruct) changed the game’s physics. The model compares neck-on-neck with Anthropic’s Sonnet and Opus models.

The philosophical divide sharpens monthly. While Anthropic negotiates a raise at $170bn valuation, Alibaba practically gives their model away as open source. Seven months from DeepSeek v3 to Qwen3, with market panic in between, suggests we’re early in an exponential curve.

I remain a huge fan of Anthropic’s work. But we must acknowledge the risk that Western investors, focused on quarterly revenue growth, might miss the inflection point. Again.

The 15% Solution

In July, Trump achieved something unexpected. He has seemingly reshaped global trade with just a short run of market panic in April. The EU accepted 15% baseline tariffs—up from 1.2% but below the threatened 30%. In exchange, Europe commits to $750 billion in US energy purchases and $600 billion in investments. For a president who measures success in deals, this does look like a prize winner.

Many of us thought the EU would put up more of a fight. After all, the US/EU trade balance more or less balances, when you take services and IP payments into account.

But the geopolitical situation was more complicated. For a continent with a revanchist neighbour on its doorstep, Europe is poorly defended. Especially if you think the US might pull their security guarantees.

For decades, the continent saved 1-2% of GDP by outsourcing security to America. So in some ways, one can say that Europe racked up a defence debt to the US, and that the same defence bill was due for collection this month. Unable to defend Ukraine alone, dependent on US weapons and intelligence, Europe negotiated from weakness. Fifteen percent tariffs are simply the price of strategic dependence.

From a US perspective, the Victory narratives obscure underlying inflation arithmetic. July’s inflation data revealed import-intensive categories leading price increases. When inventory buffers empty and tariffs bite fully, inflation could quickly head back above 3%. Trump may accept this trade-off—strategic victories sometimes require tactical costs. We should expect some wobbles in markets if we start seeing a 3-handle on inflation data.

The Figma Celebration

For an industry starved of liquidity, Figma’s IPO delivered. Priced at $33 per share with 40x oversubscription, the company listed at a $19.3 billion valuation, then promptly rocketed to $115.50/share on the day of listing. Not many investments offer a 250% return in 24 hours, yet here we are.

The wider picture is promising for the venture industry. After years of waiting, VC investors finally get a proper SaaS exit—not infrastructure plays like CoreWeave, not crypto-adjacent like Circle, but enterprise software with $1 billion ARR growing 40%.

The numbers sing: 91% gross margins, 132% net dollar retention, used by 78% of Forbes 2000 companies. Dylan Field, who started this at 20 and is now 33, built the bellwether. If Figma prices well, dozens more might finally follow. And provide much-needed distributions back to long-waiting LPs.

The Questions Beckon…

Two paradoxes define this moment. First: how can markets keep climbing when inflation creeps higher, driven by the very tariffs Trump is celebrating? Second: how can Anthropic command $170 billion when Alibaba offers comparable performance for free?

The answer lies in AI’s transformative potential outweighing near-term headwinds.

Markets aren’t ignoring inflation—they’re betting AI productivity gains dwarf it. When law firms cut costs 90% and developers triple output, even 3% inflation becomes manageable. The S&P climbs because AI creates more value than tariffs destroy. This calculation holds as long as adoption accelerates and efficiency compounds. So far, it does.

The second paradox resolves through enterprise reality. Yes, Qwen3 matches Claude’s benchmarks at 1/68th the cost. But Fortune 500 CTOs buy US data residence, enterprise SLAs, and vendor liability. When AI unlocks millions in productivity gains, paying $15 instead of $0.22 per million tokens remains a rounding error. Anthropic’s 28-34x multiple follows naturally from $1 billion to $4 billion revenue in six months.

…but for how long?

This logic holds—today. Technology teaches that today’s moat becomes tomorrow’s commodity. Unless Anthropic continues to out-innovate, Fortune 500 CIOs will realize they can run open source models in AWS data centers on US soil.

We’re not in bubble territory yet. Unlike 1999’s revenue-free dot-coms, today’s AI leaders deliver real growth, real customers, real cash flows. The risk isn’t that the potential of AI disappoints—it’s that execution fails to match potential.

Markets rarely move in straight lines. And we expect corrections along the way. Corrections in transformative cycles shake out tourists and create entry points for those who see the longer arc.

The medium-term trajectory remains intact because the fundamentals are real. AI isn’t creating value in theory—it’s creating value today, measurably, repeatedly. Short-term volatility changes prices, not prospects.

Onwards!

Seven months from DeepSeek v3 to Qwen3. January’s panic gave way to July’s shrug. The difference? Nvidia’s revenue keeps climbing. Anthropic grew from $1 billion to $4 billion. Meta and Microsoft crush earnings. Markets have concluded that revenue growth validates the AI thesis—Chinese models be damned.

The real triggers for correction lie elsewhere. Watch Nvidia’s next earnings call. Track Anthropic’s path from $4 billion to $10 billion. Monitor enterprise AI budgets. If and when these wobble, markets will follow. The bet is simple: as long as Western AI companies deliver revenue growth, model performance parity doesn’t matter. Markets believe we’ve learned from DeepSeek—that demand trumps disruption.

The 15% tariffs are now reality. Inflation will creep higher as buffers empty. Chinese models will keep improving weekly. None of this changes the fundamental equation: AI creates more value than it costs, by orders of magnitude. This gap drives everything else.

For now, the productivity gains compound faster than any headwind. Figma’s IPO shows traditional software still has value. Europe pays its bills while building its future, creating more opportunity in European tech than we’ve seen in decades.

The patterns are clear. The opportunity clearer still.

Position accordingly.